- XRP outpaces its rivals as FOMO builds, reclaiming the elusive $1 level after three years.

- To hit $2, bulls must squeeze weak hands.

Ripple [XRP], the standout underdog of this cycle, has once again outpaced its rivals, closing the week with an impressive 8% surge in market cap, now standing at $87 billion.

This resurgence has fueled speculation that XRP might reclaim its all-time high of over $3 sooner than its peers, especially after breaking past the elusive $1 mark for the first time in over three years.

While FOMO runs high among retail investors hoping for even greater returns, some might view the current rally as a prime opportunity to exit, warning of a potential correction as the coin shows signs of overheating.

In light of this anomaly, AMBCrypto delved into XRP’s prospects of hitting $2 next, potentially flipping Binance Coin [BNB] to claim the fifth spot in market capitalization.

Bulls appear psychologically primed

In the 2021 cycle, when XRP reclaimed the $1 mark, its price movement was more erratic and inconsistent, as shown on the daily price chart, with the RSI lingering in the overbought zone.

Consequently, before XRP could reach $2, the trend reversed, pulling the coin back into the red. Since then, Ripple has steadily worked to regain its $1 benchmark – a milestone finally achieved three years later.

Psychologically, this long-awaited comeback might set the stage for heightened FOMO, as investors, eager to capitalize on XRP’s current bull rally, are now less willing to wait for a new all-time high.

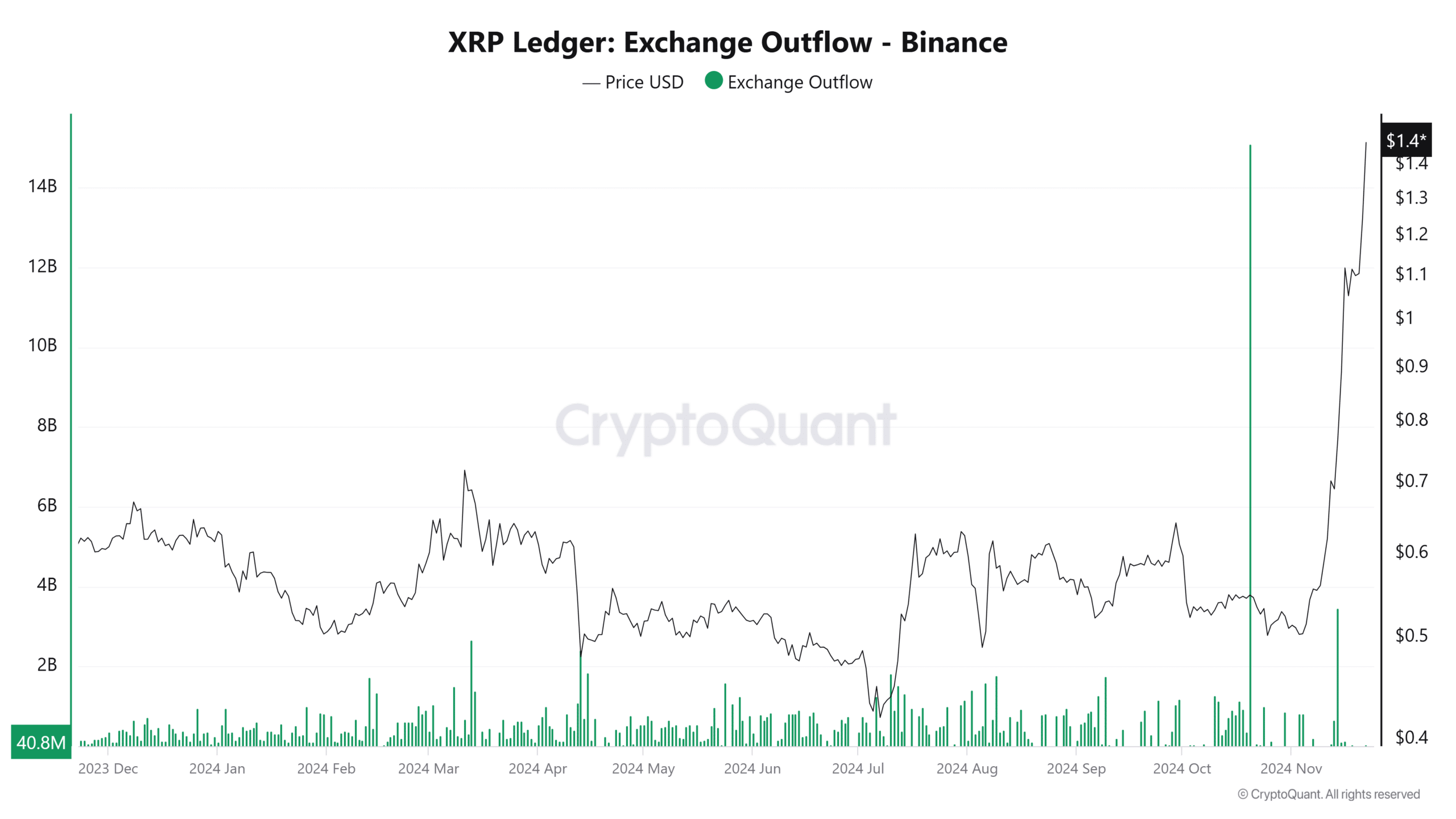

Interestingly, just three days ago, XRP withdrawals from Binance reached a record high of approximately 15 billion tokens.

This notable event occurred four days after XRP consolidated around the $1 level, with mild bearish pressure evident on the daily chart.

This indicates that bulls effectively pressured weak hands into exiting the market, as many feared an imminent correction after XRP reached key price targets within just 10 trading days.

Instead of retreating, however, the bulls showcased remarkable resilience, initiating the largest accumulation phase in XRP’s history – further reinforcing AMBCrypto’s earlier observations on the impact of FOMO.

Put simply, before Ripple could falter as it did three years ago, with most stakeholders exiting the cycle, the bulls stepped in, aggressively buying up the sold XRP tokens to prevent a pullback.

Their efforts paid off as XRP surged over 12% the following day.

However, to reach $2 next, bulls must sustain consistent buying pressure. Otherwise, the risk of a pullback remains significant, especially given XRP’s rapid ascent to $1.55 (at the time of writing) with double-digit daily gains.

So, is $2 within reach for XRP?

While XRP has attracted notable capital from Bitcoin [BTC], which continues to consolidate below the historic $100K target, once BTC reaches its mark, the entire crypto market could undergo a major shift.

Certainly, BTC may dominate the spotlight, but given the high stakes of its price range, some selling pressure is likely to emerge – something XRP bulls could capitalize on.

Although Ripple is performing bullishly across various metrics, bulls must sustain the current accumulation trend to maintain its dominance over rivals and position it as a strong alternative to Bitcoin during bull runs.

Realistic or not, here’s XRP market cap in BTC’s terms

If this trend continues in the coming days, $2 could be within reach for XRP, potentially paving the way for a parabolic run to a new all-time high.

This scenario appears increasingly plausible as bulls remain resolute in countering bearish pressure, with strong FOMO and sustained accumulation positioning XRP as a key beneficiary for investors reallocating profits from Bitcoin into Ripple.