- Injective experienced a significant surge in Total Value Locked (TVL), reflecting growing confidence in its blockchain.

- However, this has been overshadowed by persistent retail sell-offs, which continue to exert downward pressure.

After gaining 9.33% over the past month, Injective [INJ] is losing steam, with a 5.06% pullback in last week’s sessions. Daily losses have compounded the decline, with an additional 1.60% drop as shifting market sentiment drags its value further down.

Can INJ’s TVL surge drive a price rebound?

According to Chainbroker, Injective witnessed a staggering 61.2% increase in Total Value Locked (TVL) over the past seven days, pushing the metric to $2.52 billion—a clear sign of growing confidence in its ecosystem.

TVL, a key indicator of DeFi protocol performance, represents the total value of assets staked, lent, or provided as liquidity. While such surges often align with upward price momentum, INJ’s case breaks the mold.

Despite the impressive TVL growth, INJ’s price has dropped by 5.06% during the same period, suggesting waning confidence among market participants.

Further analysis attributes this price decline to sustained selling pressure from retail traders, overshadowing the blockchain’s expanding utility.

Retail traders turn bearish on INJ

Data from IntoTheBlock reveals increasing selling activity, with bearish sentiment among retail traders becoming more pronounced.

The average transaction size, which tracks the mean value of daily transactions, has declined over the past week, settling at $6,419.46. Such sluggish movement is often indicative of reduced retail trader activity, signaling a cautious or bearish market outlook.

This slowdown is further corroborated by a 15.94% drop in Daily Active Addresses (DAA) over the same period. A decline in DAA typically reflects waning interest and increased selling pressure, both of which have contributed to INJ’s recent price downturn.

Additionally, the bearish market sentiment is reflected by long liquidations totaling $754,270, as traders are forced to close positions amid continued downward momentum.

The market’s push to the downside remains evident, with retail-driven pressure playing a significant role in INJ’s recent struggles.

Whales hold back, leaving INJ’s market direction uncertain

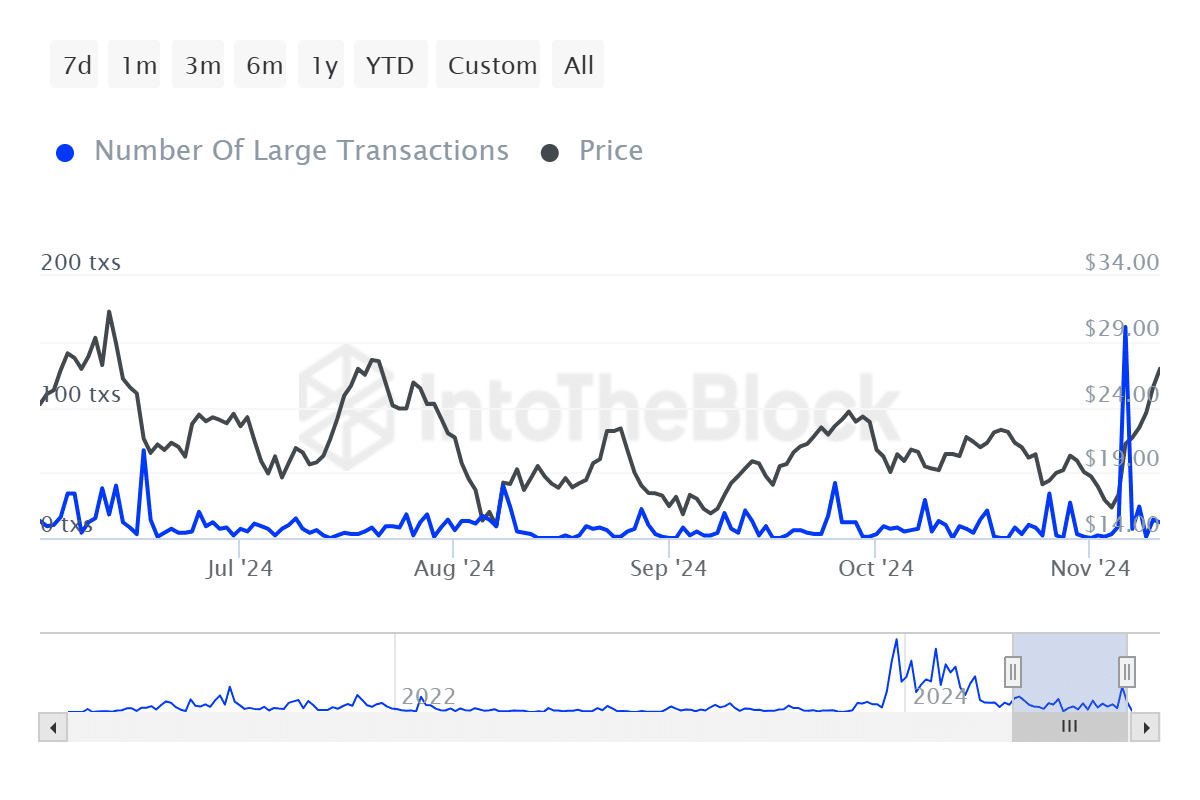

Large investors, or “whales,” have remained inactive in recent times, with only one major transaction recorded in the past 24 hours and a modest total of 22 large transactions over the last seven days.

Such low activity suggests that whales are currently indecisive, refraining from making market-shifting moves.

Read Injective’s [INJ] Price Prediction 2024–2025

Typically, a surge in large transactions would signal a more decisive trend: an increase accompanied by a price drop indicates bearish sentiment, while an increase coupled with a price rise suggests bullish momentum.

The occurrence of either scenario could play a deciding role in shaping INJ’s next major market move, making whale activity a critical factor to watch in the coming days.