- The crypto week ahead presents a possible spike in volatility for AI cryptos, thanks to Nvidia’s Q3 earnings

- S&P Global’s manufacturing and services PMI data could also drive volatility for various cryptos, including memecoins.

Bitcoin [BTC] formed a fresh all-time high above $94,000 after BlackRock’s Bitcoin exchange-traded fund (ETF) options went live.

Bitcoin has since erased some of these gains, causing the total crypto market capitalization to drop slightly by 0.06% at press time to $3.09 trillion.

Despite this slight dip, the week ahead presents new opportunities for crypto traders amid several key events that could spike volatility.

AI cryptos rally ahead of Nvidia earnings

Artificial intelligence (AI) chipmaker Nvidia will release its third-quarter earnings on the 20th of November. Historically, Nvidia’s financial results tend to stir moves across the crypto market, with the most volatility being seen in AI cryptos.

Render [RNDR], one of the top AI cryptos with a $4.1 billion market cap, is already reacting to the development. In 24 hours, RENDER has gained by 7% to trade at $8.09 at press time.

GRASS [GRASS], another AI crypto with a $600M market cap, was also trading higher, with a 4% gain in 24 hours to trade at $2.45 at press time.

The market is expecting Nvidia to post strong data, as the company’s stock rallied by 4% a day before the release. This could bode well for the AI & Big Data crypto sector this week.

Memecoins outperform the broader market

Memecoins have been outperforming most altcoins, and if the positive sentiment in the broader cryptocurrency market continued during the week, this sector could post more gains.

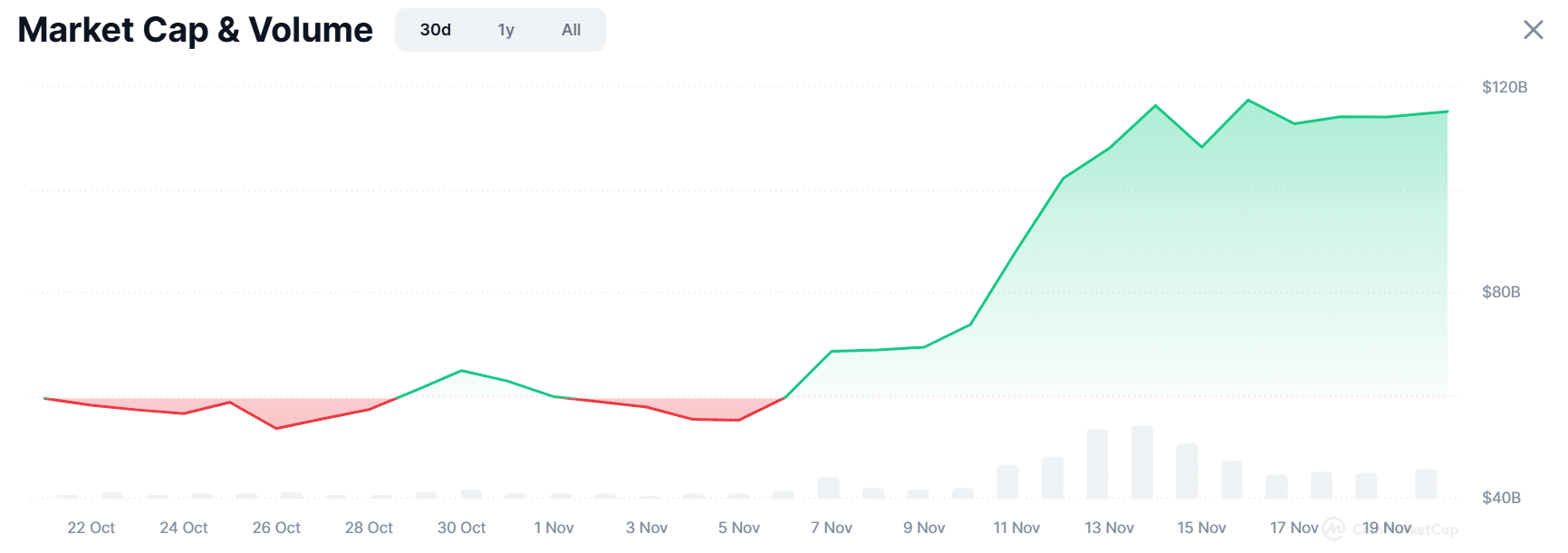

Data from CoinMarketCap showed that in just 30 days, the total market cap for the memecoin sector has nearly doubled from $59 billion to $115 billion at press time.

At press time, Solana [SOL]–based memecoins were leading gains. BONK [BONK] was up by 12% in just 24 hours, to trade at $0.0000556. BONK had formed an all-time high of $0.000059 on the 20th of November before retreating to find support.

Goatseus Maximus [GOAT] has also jumped by nearly 10% in 24 hours and 35% in seven days. These gains also highlighted the growth of the memecoin sector.

However, a memecoin rally is often driven by Bitcoin’s price performance. If BTC sustains a positive trajectory, this sector could see further gains in the near term.

U.S. economic data

The crypto week ahead could also present bouts of volatility due to the release of manufacturing and services Purchasing Managers Index (PMI) data.

This data will be released by S&P Global later this week to highlight the performance of the U.S. manufacturing and services sector.

In October, the data was better than expected and portrayed a strengthening U.S. economy.

A strong PMI could offer another boost to cryptocurrency prices. However, signs of weakness could cause a slight decline in the near term.

Overall market outlook is positive

As the crypto market braces for these events in the week ahead, the Fear and Greed Index showed that euphoria is influencing trader behavior.

At press time, this index stood at 83, showing a state of extreme greed. However, this metric has dropped from 90 in 24 hours, suggesting that the market could be cooling off, paving the way for price stability.