- Bullish momentum seemed to be on PEPE’s as December’s 10x rally loomed

- PEPE’s rising hashrate pointed to bullish momentum too

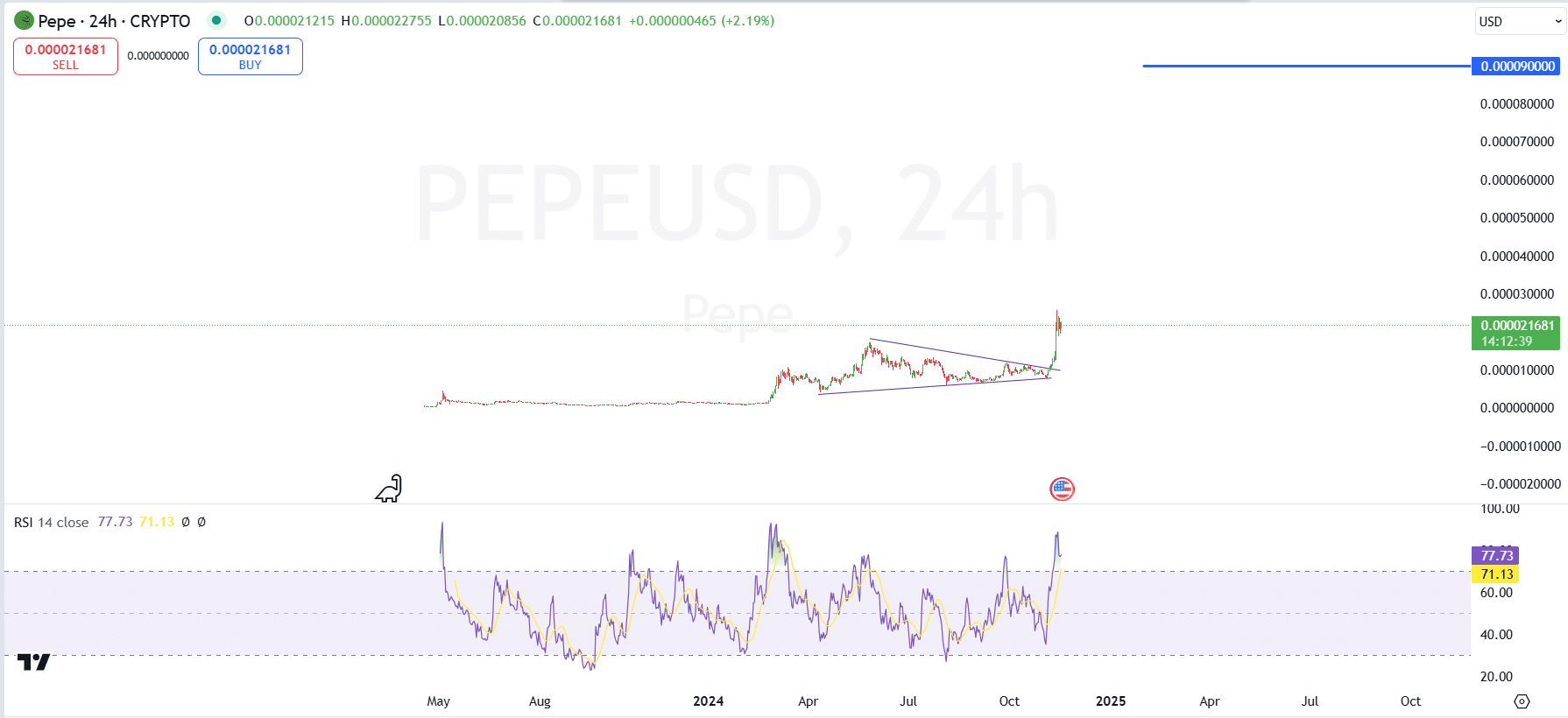

At the time of writing, PEPE Coin was trading at $0.00002101, with a 24-hour trading volume of $4.85 billion. This, after the altcoin recorded a minor uptick on the 24-hour charts, pushing its market capitalization to approximately $8.86 billion.

PEPE’s latest price action reflected a consolidation phase though, forming symmetrical triangle patterns that historically allude to the potential for a significant breakout on the charts. Needless to say, this technical setup has caught traders’ attention. Especially as it seemed to mirror the token’s February rally where PEPE achieved a staggering 10x surge in just 40 days.

In light of increasing momentum and strong market interest, a rally to $0.0009 by 16 December is possible – Marking another milestone for the token.

The memecoin’s RSI (Relative Strength Index) supported this outlook, suggesting that bullish momentum has been building. However, the next move will depend on key confirmations of a breakout from the symmetrical triangle formation.

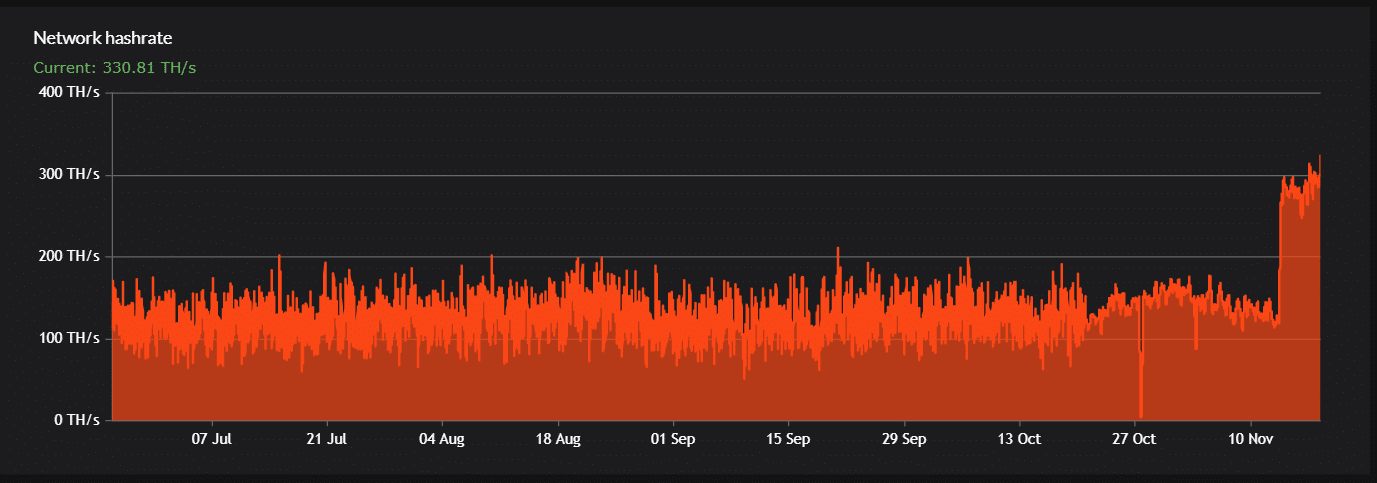

PEPE hashrate surges to 330 TH/s, boosting network security

The chart revealed a sharp hike in PEPE’s network hashrate, with the same hitting 330.81 TH/s. Here, hashrate measures the computational power used by miners to validate transactions and secure the blockchain.

A higher hashrate means high mining activity, greater network security, and enhanced decentralization – All of which boost confidence in the blockchain’s reliability.

Such a surge suggests growing miner interest, likely due to improved profitability or anticipation of future price appreciation. For PEPE, the rising hashrate could have a positive impact on its price by signaling a stronger and more secure network.

An uptick in mining participation often correlates with bullish sentiment, attracting both traders and investors. However, it also intensifies mining competition, which can affect profitability.

PEPE’s bullish trend cools down

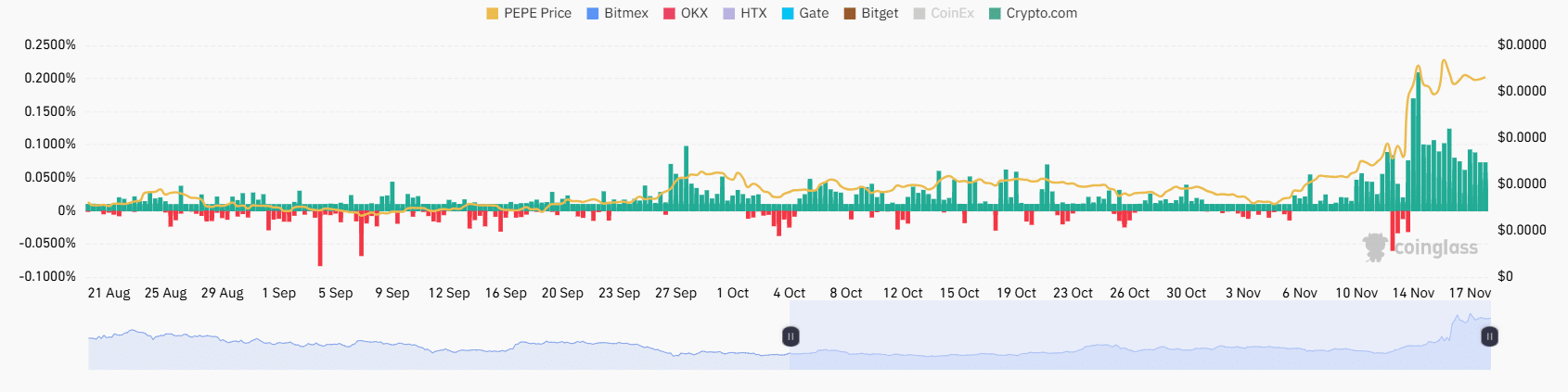

From 05 November, PEPE began a steady rise in price, gradually gaining bullish momentum as funding rates across major exchanges like Bitmex, OKX, and Gate turned increasingly positive. In fact, uptrend peaked on 04 November – Marking a significant surge supported by heightened trading volume and strong long positions.

During this period, traders exhibited growing confidence, with positive funding rates highlighting willingness to pay premiums for holding bullish positions.

After 14 November, the memecoin’s price began to decline steadily, accompanied by fluctuating funding rates. While funding remained positive at times, signaling lingering bullish sentiment, intermittent negative funding rates indicated profit-taking and market hesitation.

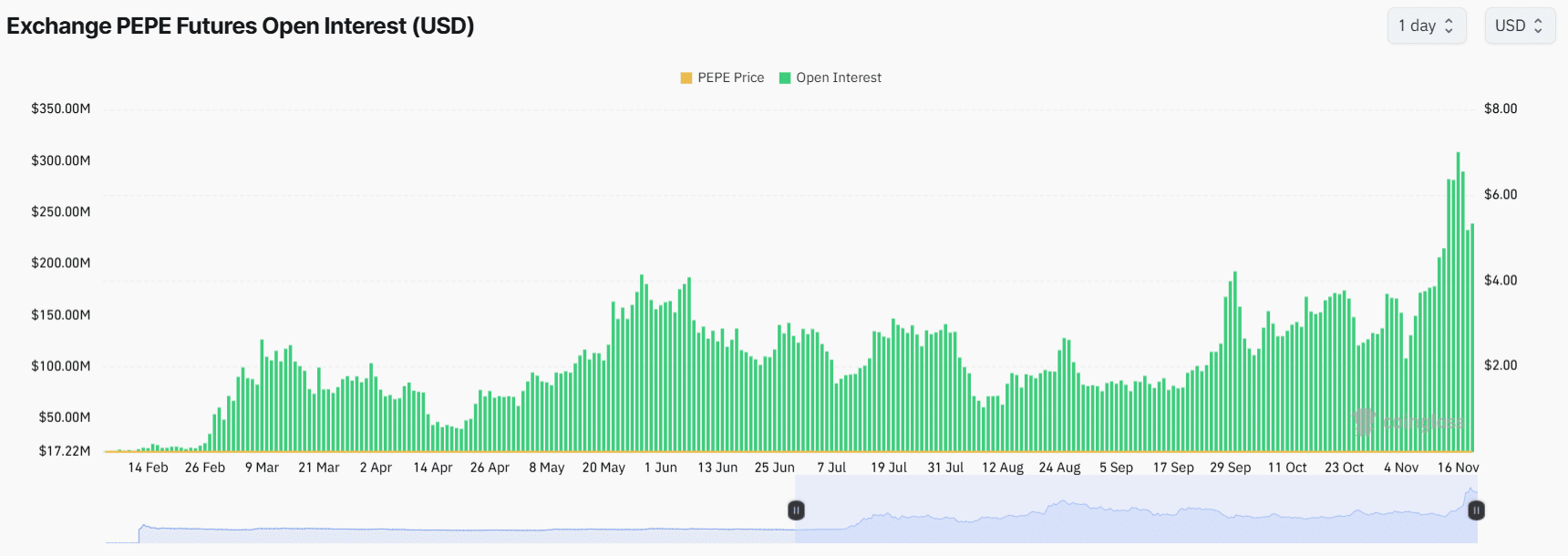

In parallel with this consolidation, PEPE’s Futures Open Interest peaked at $308 million on 16 November – This alluded to a significant hike in market activity and trader participation.

This peak seemed to be in line with PEPE’s recent bullish price momentum – A sign of heightened confidence among traders and a surge in speculative interest.

Finally, Open interest represents the total value of outstanding futures contracts, and its steady rise prior to 16 November showcased strong momentum and liquidity in the market.

Worth noting though that Open Interest had declined to $239 million by 18 November, indicating some unwinding of positions.

This reduction may suggest profit-taking or a shift in sentiment following the peak. While the aforementioned fall could point to caution among traders, the Open Interest remains elevated. What this means is that there’s still some sustained interest in PEPE.