- The crypto fear and greed index hit ‘extreme greed’ as bullish bets on +$100K intensified.

- The retail market was back and could compound a price pullback scenario for BTC.

Bitcoin [BTC] has fluctuated around $90K for a while, but the market interest has remained elevated, hitting an ‘extreme greed’ status per the Crypto Fear and Greed Index (FGI).

According to Soso Value data, this was the fifth ‘extreme greed’ signal (above 80) on FGI since 2021.

Per historical trends, an FGI above 80 coincided with BTC’s local and cycle tops. In early 2024, BTC hit a local top above $73K when an ‘extreme greed’ status was hit.

In 2021, a similar signal correlated with a local top in February, followed by a cycle top in August.

Will the trend repeat and trigger a price pullback? Extreme bullish sentiment in the options market disagreed with such a scenario, at least until BTC hit +$100K.

BTC options traders eye $95K — $110K targets

According to the latest data insights from Deribit, large players’ positioning remained bullish as they dumped $75K and $85K puts (bearish bets) and increased $95K-$110K calls (bullish bets).

Part of the Deribit update read,

“Notional roll-up of Nov 84k to Dec 90k Calls. Additional early buying of Nov90, Dec90+95k Calls.2-way action Nov+Dec 100k Calls. Later dumping of Dec 75+80k Puts + 90k Calls+ Straddles. Buying across Dec+Mar 110k+ Call spreads. Positioning remains bullish bias.”

Put differently, most hedge funds didn’t expect BTC to drop below $80K or $75K (selling of Dec 75+80K puts).

On the contrary, they eyed further rally, with potential targets of $95K-$110K between December and early 2025.

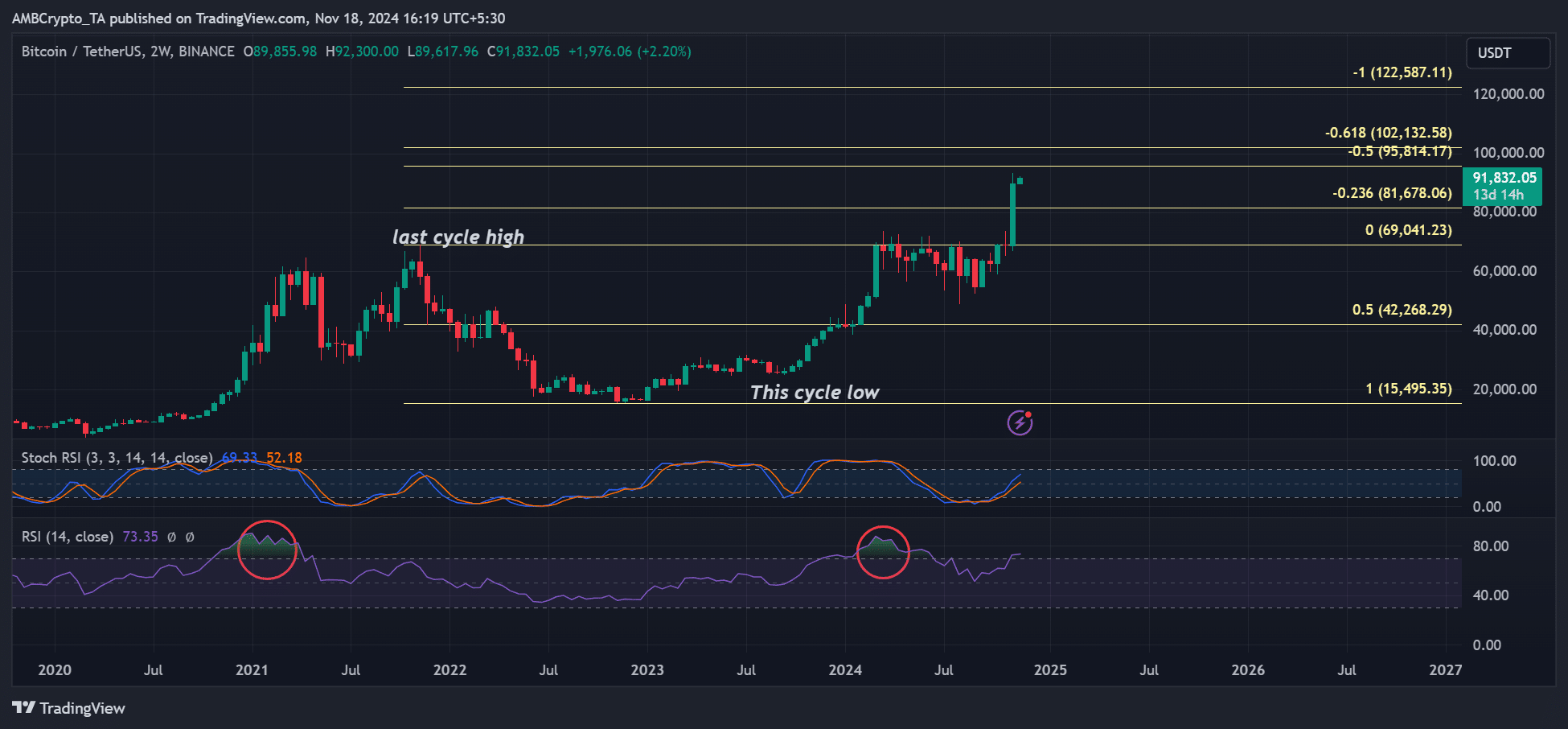

Similar price targets were painted on the BTC’s 2-week chart. The next key upside targets were at $95.8K and $102K.

With the price momentum, the Stochastic RSI, inches away from hitting an overbought condition, BTC could attempt to eye these targets.

However, the retail was back in the market, one of the loudest signals of a likely local or cycle top, as whales always use them as exit liquidity.

Read Bitcoin [BTC] Price Prediction 2024-2025

However, CryptoQuant founder, Ki Young Ju, cautioned that a price correction could be likely but might not mark the beginning of a bear phase. He said,

“If I were a giga whale, I’d wait for more exit liquidity. It’s just starting. Imagine retail in FOMO joining at $100K. We might see some corrections, but it wouldn’t mark the start of a bear market, imo.”