- TAO showed no signs of recovery as it traded near a critical support level historically linked to price rallies.

- Multiple technical and market indicators aligned, signaling a strong likelihood of further declines.

Bittensor [TAO] has consistently underperformed across multiple timeframes. On a monthly scale, the token has suffered a 14.22% drop.

In the press time daily session, TAO extended its losses, opening with a sharp 5.05% decline, confirming its continued downtrend.

AMBCrypto had previously highlighted that TAO was on precautious ground. The current price slide appeared to be driven by broader market weakness, leaving the asset vulnerable to a deeper slump.

Can TAO hold its ground at key support?

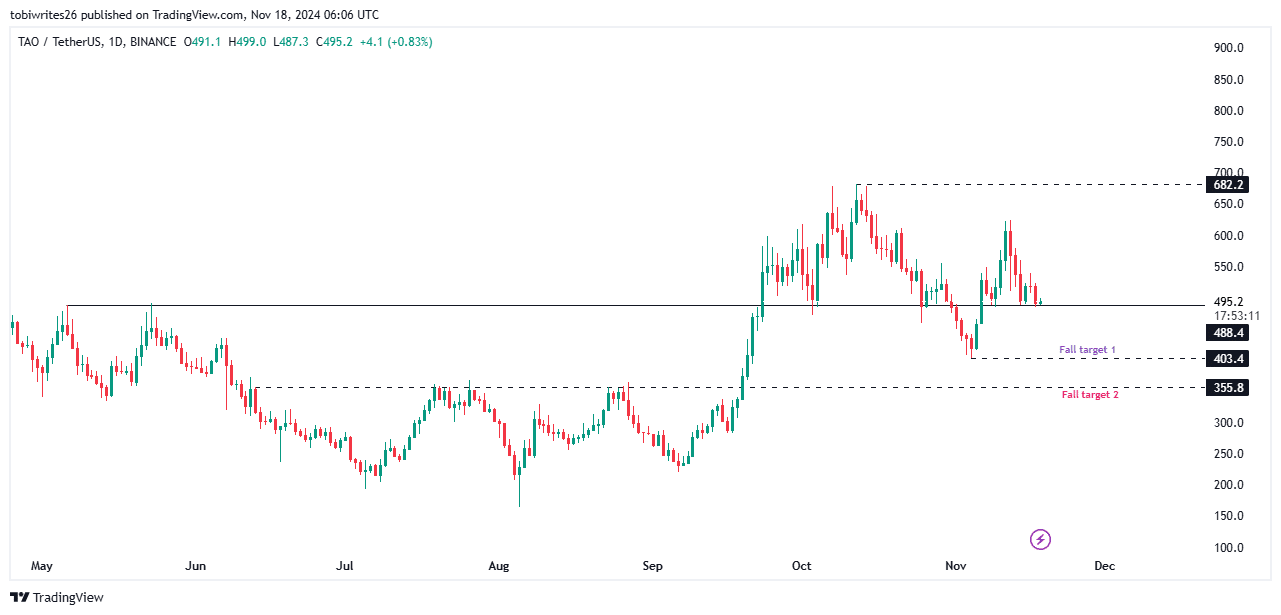

TAO was trading at a critical support level of $488.4 at press time, a zone that has previously triggered significant price reversals.

On two prior occasions, this level served as a launchpad for rallies, and traders are now watching closely as TAO makes its third test of this support.

If history repeats itself, a successful rebound could see TAO rally to $682.2. However, failure to hold this level may open the door to further declines.

Initial downside targets lie at $403.4, with a deeper drop to $355.8 possible if selling pressure intensifies.

To forecast TAO’s next move, AMBCrypto analyzed additional metrics, highlighting key factors that could determine the asset’s trajectory.

Bearish sentiment takes hold of TAO

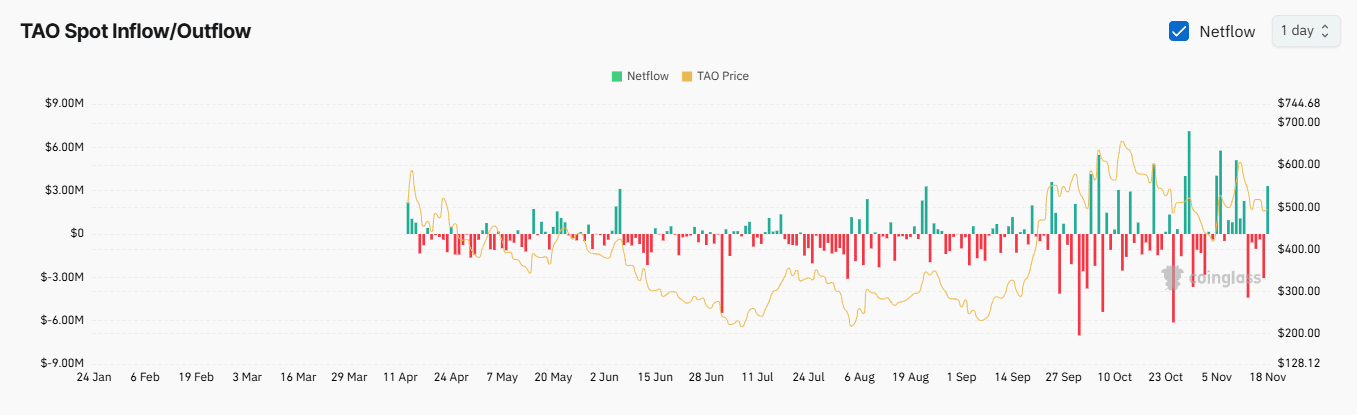

Market sentiment around TAO has shifted bearish, according to AMBCrypto’s analysis using Coinglass data.

In the past 24 hours, TAO’s Exchange NetFlow has turned positive, indicating more tokens have been deposited into exchanges than withdrawn.

A positive NetFlow typically signals potential sell-offs as traders position themselves to offload their holdings. At the time of writing, over $3.90 million worth of TAO had been deposited, likely with the intent to sell.

Additionally, the market witnessed significant long liquidations, with $295.62K worth of long positions closed compared to just $9.59K worth of shorts.

This imbalance suggested that traders betting on a rally have been forced out of their positions as bearish pressure intensified.

Further analysis revealed a Long-to-Short ratio of 0.9084, indicating more traders were placing bets on TAO’s decline than on its recovery. This trend reflected the growing pessimism among market participants.

Indicators align with on-chain data

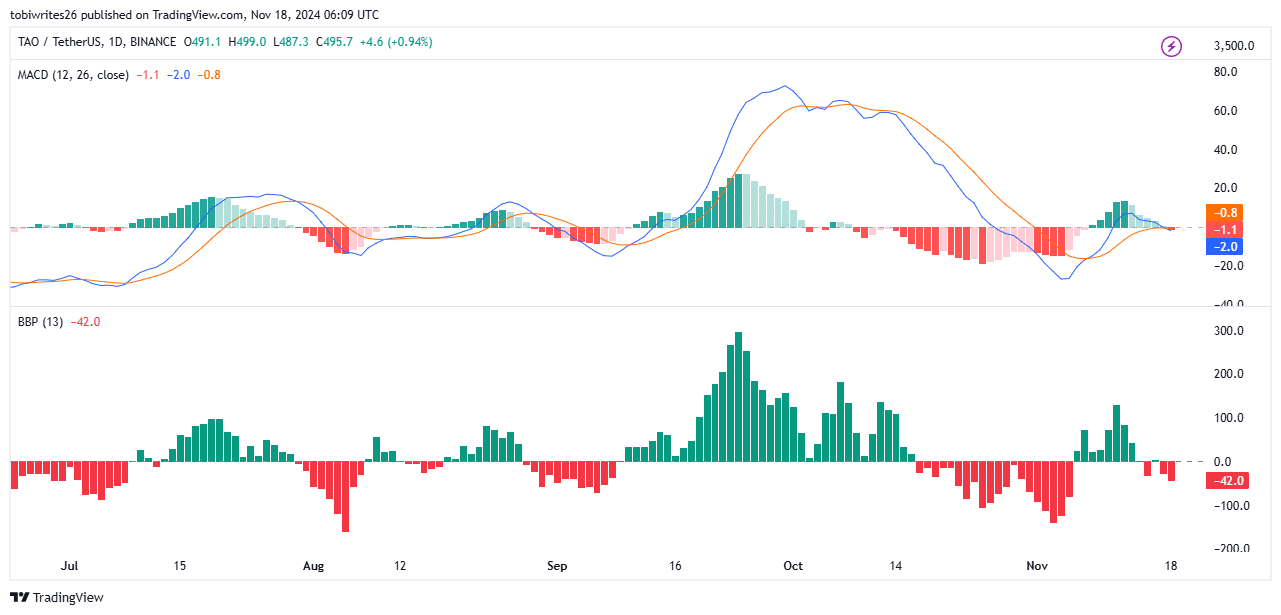

Technical indicators confirmed the bearish outlook for TAO, with tools like the Moving Average Convergence Divergence (MACD) and Bull Bear Power highlighting a strong presence of sellers in the market.

The MACD has formed a “death cross,” a bearish signal that occurs when the blue MACD line crosses below the orange signal line. This pattern on the chart below often precedes a decline in momentum, reinforcing the downward trend.

Adding to this, the Bull Bear Power indicator further underscored the dominance of Bittensor bears.

Read Bittensor’s [TAO] Price Prediction 2024–2025

The growing red momentum bars on the indicator revealed that sellers were currently in control, intensifying the bearish sentiment.

Based on these technical metrics, the overall market sentiment remained bearish, suggesting the likelihood of further declines for TAO.