- XLM’s breakout above $0.1236 signaled a potential trend reversal.

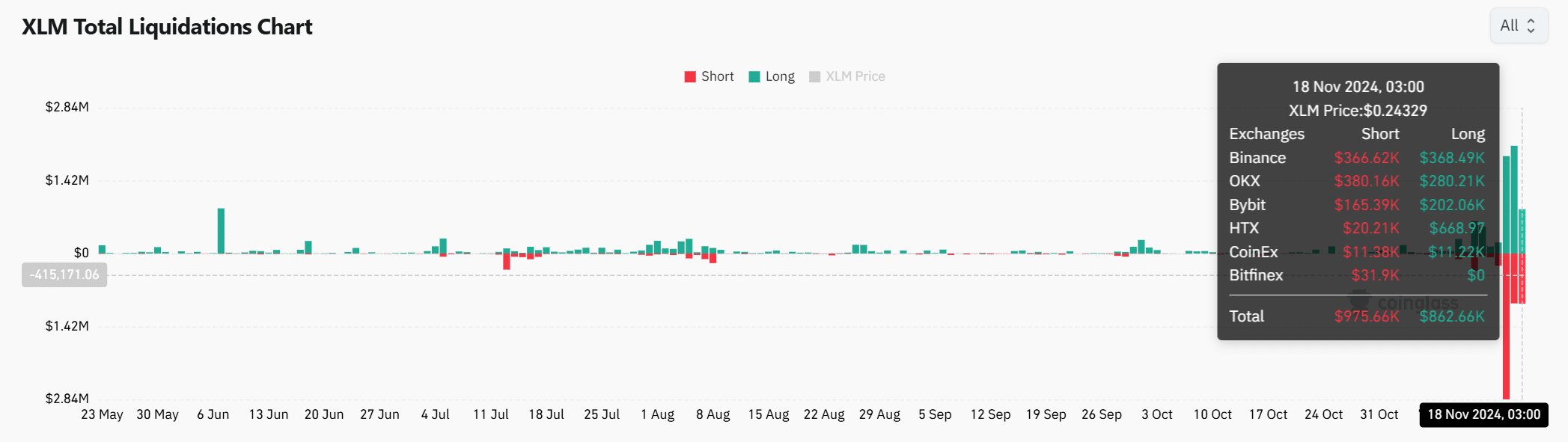

- Rising Open Interest and $975K in short liquidations highlighted growing bullish momentum.

Stellar [XLM] has electrified the market, surging by 24.08% in the last 24 hours, with its price at $0.2533 at press time.

This sudden upward momentum has shattered its long-standing descending channel, igniting hopes of a sustained bullish trend.

Investors are now closely watching to see if this marks the beginning of Stellar’s next major rally.

XLM breaks free from descending channel

For months, XLM’s price was trapped within a descending channel, creating uncertainty among traders. However, the breakout above the crucial $0.1236 resistance level signaled a significant shift.

The price has soared to $0.2533, more than doubling its channel lows.

Analyzing the technical indicators, the MACD showed a bullish crossover, with the MACD line at approximately 0.0140, surpassing the signal line at 0.0139.

The Bollinger Bands have widened significantly, with the upper band near $0.2125, the lower band at $0.0347, and the midline (SMA) around $0.1236.

The press time price of $0.2533, trading well above the upper band, underscored the strong bullish momentum driving the rally.

Social volume drop raises questions

Interestingly, while XLM’s price has skyrocketed, its social volume has dropped drastically from 142 to 49 within 24 hours. This decline suggests that the rally may not yet have widespread retail enthusiasm behind it.

Consequently, it’s likely that institutional or larger traders are driving the breakout.

This disconnect between price action and social buzz raises caution, as broader retail engagement often strengthens rallies.

Should the social volume regain traction, it could reinforce this upward momentum and bring additional buyers into the market.

Short and long position impact

The recent rally caused a total of $1.837 million in liquidations, with $975,000 in shorts and $862,000 in longs being wiped out.

The imbalance suggests that bearish traders were particularly caught off guard by the breakout. Consequently, forced buybacks from short sellers significantly contributed to the upward momentum

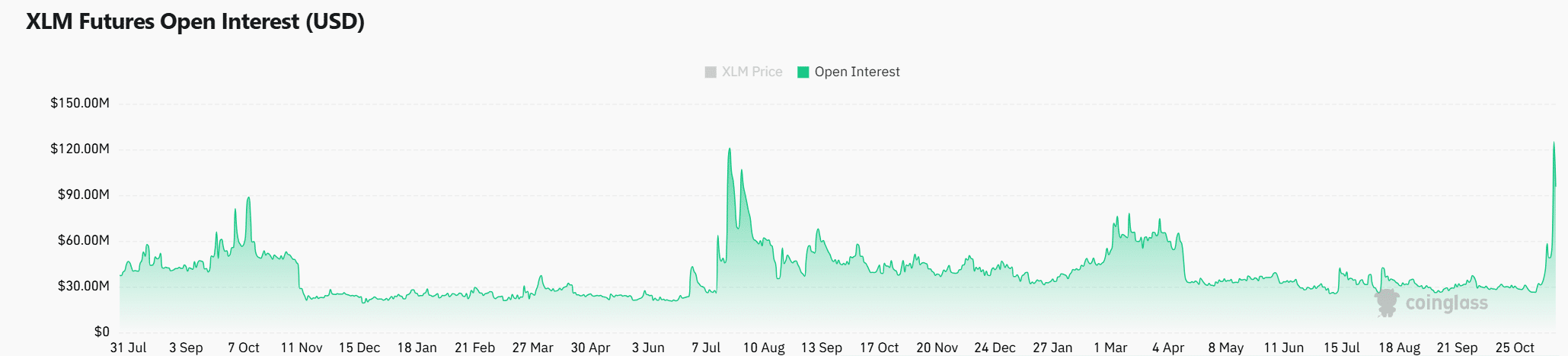

Open Interest climbs to $121.44 million

Additionally, Open Interest surged by 13.40%, reaching $121.44 million, signaling renewed interest among traders.

This increase underscored heightened activity in the derivatives market, reflecting growing confidence in XLM’s bullish momentum.

Higher Open Interest often correlates with increased volatility, suggesting that further price movement is likely in the near term.

Conclusion: Is this XLM’s moment?

The combination of a descending channel breakout, strong technical indicators, and rising Open Interest makes a compelling case for Stellar’s rally to continue.

Realistic or not, here’s XLM’s market cap in BTC’s terms

However, the decline in social volume hinted at a cautious rally driven by institutional investors.

If XLM maintains support above $0.25 and garners broader retail attention, this could be the beginning of a sustained bullish trend.

![Stellar [XLM] surges 24.08%: Is this the start of a massive rally?](https://hamsterkombert.com/wp-content/uploads/2024/11/Stellar-XLM-surges-2408-Is-this-the-start-of-a.webp.webp)