- DOT has shown classic signs of a healthy, growth-driven retracement.

- However, patience may get tested before a breakout materializes.

Polkadot [DOT] has mirrored the broader market’s recovery, breaking out of a 4-month slump, largely fueled by post-election hype that pushed it close to $6. However, a three-day pullback saw it drop to $4.75, with daily lows nearing 7%.

As is often the case in crypto, every ‘dip’ presents an opportunity for investors to push the price higher by confirming resistance as new support. Trading at $5.64 at press time, if DOT has followed this strategy, odds are it could be primed to break the $6 ceiling, with the next target potentially reaching $7.

Consolidation required for DOT to break $6

Interestingly, DOT’s peak near $6 coincided with an overbought RSI on the daily chart, signaling an overheated condition. This led to panic among traders, who feared an impending correction and exited the cycle before it could occur.

Typically, an exit without sufficient buying pressure leads to a pullback. In contrast, consolidation – where there is a balance between buying and selling – often sets the stage for a breakout.

Looking at DOT’s daily chart, a retracement brought the price down to near $4.775. However, two massive green candlesticks in the days that followed, each posting a higher high, show that bulls have capitalized on the dip, purchasing DOT tokens at a discounted price.

Certainly, bulls have shown confidence in Polkadot’s long-term prospects, but this may not be enough to ensure a clear breakout. For a breakout to materialize, bulls must maintain the price above $5, potentially triggering consolidation.

The reasoning is clear: when considering the overall market performance of other coins, Polkadot is still trailing behind its rivals, many of which have posted impressive two-digit weekly gains. This volatility makes DOT more susceptible to sharp swings.

Therefore, to avoid panic selling, bulls must focus on maintaining the current momentum. Consistent accumulation will be crucial to prevent DOT from reversing course and to stabilize the price, setting the foundation for sustained growth moving forward.

$7 might still be too ambitious

As mentioned earlier, DOT is exhibiting classic signs of a healthy, growth-driven retracement, with the price expected to fluctuate within a defined range over the coming days.

This behavior results from a strategy employed by spot traders to keep DOT consolidating, particularly in a market facing uncertainty.

While the next significant move toward $7 largely hinges on whether Bitcoin breaks key psychological levels, the consistent red candlesticks moving southward on the chart below indicate a bullish outlook, positioning DOT for a potential breakout toward $6.

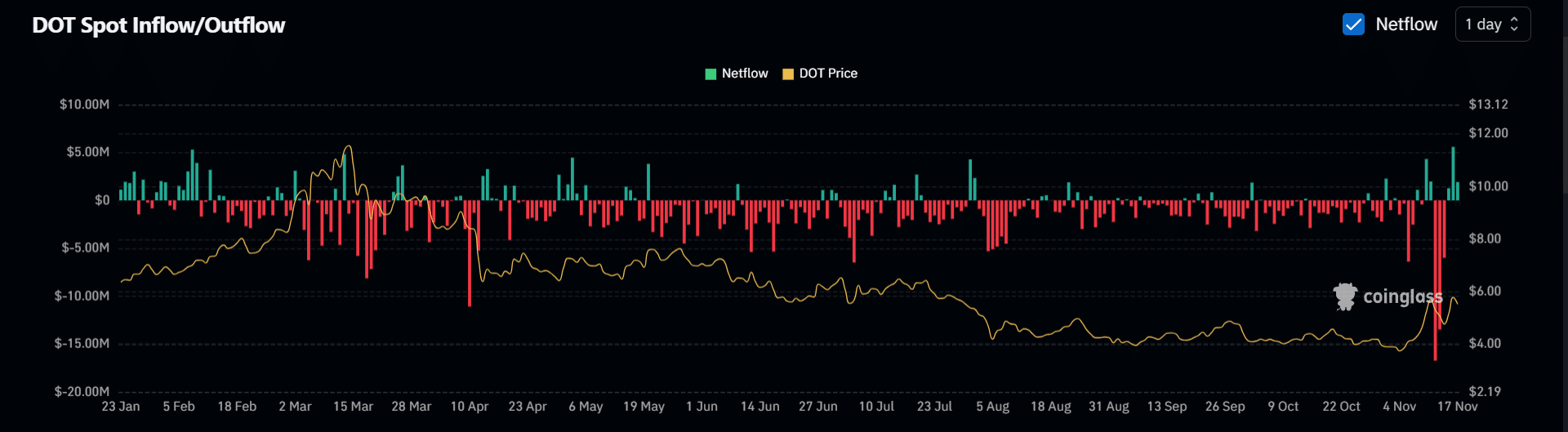

However, despite net outflows reaching a yearly high of $16.3 million, the impact on DOT’s price was contrary to expectations. While high net outflows usually signal aggressive accumulation, DOT dropped by 7%, indicating potential distribution by large HODLers.

Therefore, unless this dynamic changes, it may be difficult for DOT to target $7 next.

Read Polkadot [DOT] Price Prediction 2024-2025

While continued buyouts are expected to stabilize Polkadot and confirm $5 as a new support, a more significant accumulation from large HODLers will likely determine if DOT can approach $6.

This could shift once BTC crosses $93K, providing whales with the right incentive to enter.