- XRP has shown impressive fundamentals driving its gains, reclaiming the $1 target after three years.

- However, its future ascent to $2 will depend on how it navigates both internal and external factors.

The past week has been overwhelmingly bullish for Ripple [XRP], as it shattered expectations and surged back to the $1 mark – a milestone it hasn’t touched in over three years.

After months of consolidation, XRP has made an impressive comeback, proving its resilience.

But now comes the real test.

A perfect storm of internal and external factors has fueled this rally, not only pushing XRP past the $1 level but also propelling it into the sixth spot, overtaking Dogecoin [DOGE] with a market cap that has surged more than 10% to $60.45 billion.

So, the big question is: Can XRP keep climbing and target the $2 mark next, or is this rally too ambitious, with a lot of variables still in play?

Memecoins could be the unexpected roadblock

Typically, Bitcoin’s [BTC] consolidation has been a key moment for alternative assets to gain traction, as investors rebalance their portfolios and redistribute risk.

Like previous trends, the weekly gainers list is dominated by both low and high-cap assets. Interestingly, six out of the top 10 are meme-based tokens.

This suggests that despite XRP’s impressive 80% surge this past week, it hasn’t claimed the top spot, as the top 3 memecoins still lead.

The top performer alone has posted a four-digit weekly gain, adding fuel to the narrative of a potential ‘supercycle’ in the making.

Memecoins, therefore, are emerging as a significant challenge to XRP’s rally. Recently, DOGE, the largest memecoin, overtook XRP in market cap to reclaim the sixth spot.

Though Ripple has regained its position after an impressive rally, the fact that DOGE could flip it again adds a layer of uncertainty to XRP’s upward climb.

Given this evolving dynamic, it’s possible that Ripple may need to wait a bit longer to reach the $2 mark.

This target may seem slightly optimistic, especially with memecoins undergoing a dramatic shift from being volatile assets to leading the market during periods of high volatility – signaling their evolution into legitimate players with real use cases.

Meanwhile, looking at XRP’s daily chart, the asset has posted consistent green candlesticks in under 10 trading days, with daily highs reaching up to 20%.

However, such a rapid surge could indicate overextension. If FOMO doesn’t resurface soon, weak hands might start cashing in on gains, potentially sending XRP southward.

Bulls may have to flip $1 into support

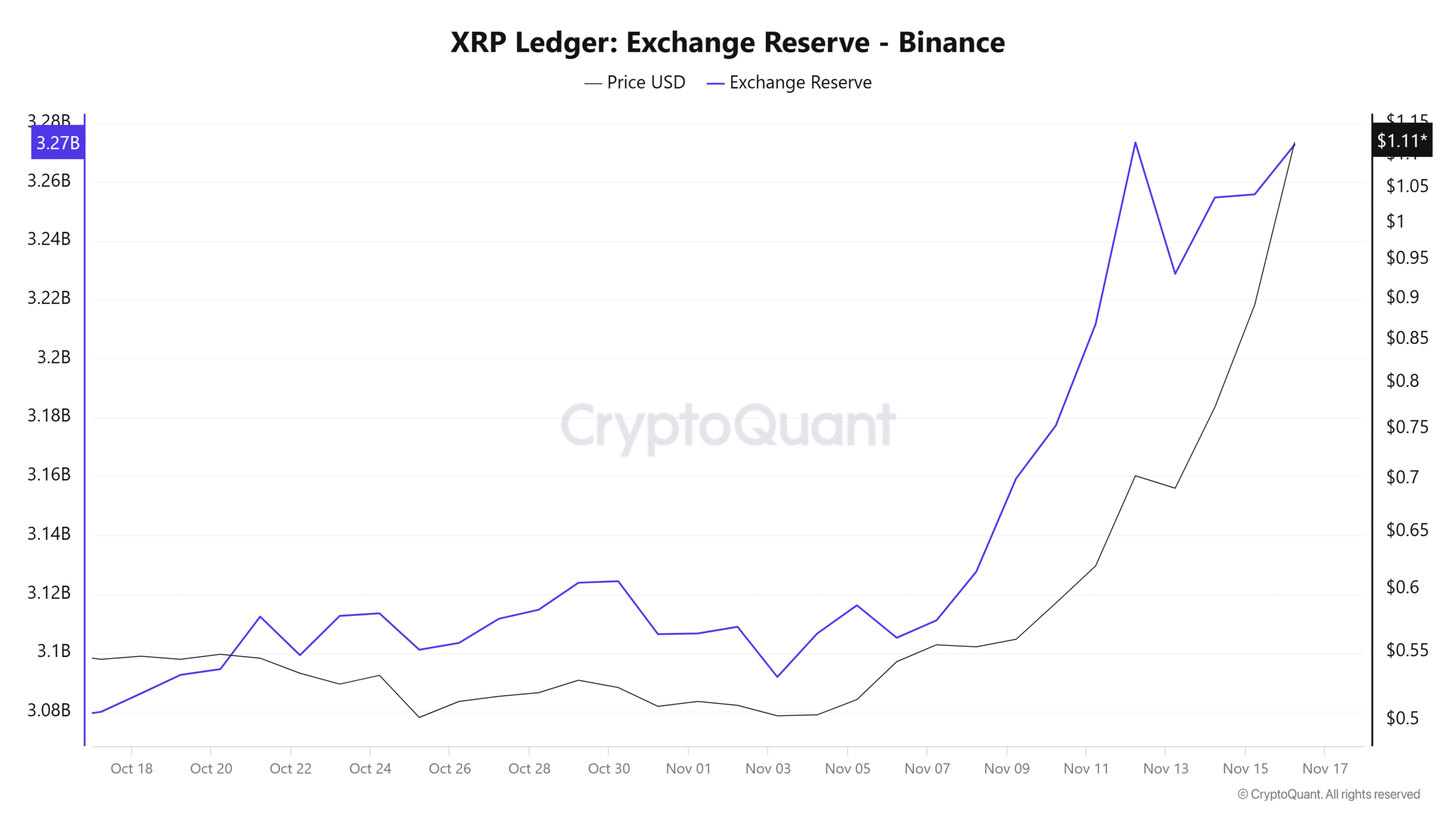

The XRP reserve has risen consistently during the onset of this month, reaching its peak five days ago, when 3.273 billion tokens were held in exchanges, marking a notable 5.41% increase from the 3.105 billion tokens held during its first week.

Interestingly, during the second week, when Bitcoin surged to $90K, driving a major rally in other altcoins, XRP’s price remained stagnant, as reflected in the increase in exchange reserves.

However, when top altcoins reached overextension, and profit-takers began exiting, XRP saw a notable dip in its exchange reserves, dropping to 3.228 billion.

This suggests that investors, wary of Bitcoin entering a ‘high-risk’ zone, strategically minimized exposure to riskier assets.

They targeted XRP’s price five days ago as a ‘dip,’ using it as an opportunity to diversify their portfolios, as most altcoins had already hit a peak.

Now, with exchange reserves building up again, it appears these investors are shifting back to other assets to capitalize their surge.

This suggests that the $1 mark may only be a short-term event unless bulls manage to flip it into solid support.

Read Ripple’s [XRP] Price Prediction 2024-25

To maintain momentum, flipping $1 into support will be crucial. If bulls succeed, monitoring whale activity will become essential, as it could signal a continued rally toward $1.15.

However, rising selling pressure, an overheated RSI, and the outperformance of memecoins pose significant challenges. Should this strategy fail, XRP risks retracing to its baseline.