- NEAR can gain 33% following its recent rally.

- However, this upward momentum depends on NEAR breaking through its current resistance level.

Over the past week, Near Protocol [NEAR] has emerged as one of the top market performers, boasting a 41.23% increase. In just the last 24 hours, it has gained 12.78%, solidifying its position for a sustained market uptrend.

While NEAR’s rally is contingent on a key factor, AMBCrypto has highlighted multiple indicators that support its continued upward trajectory.

NEAR could gain 33%, but…

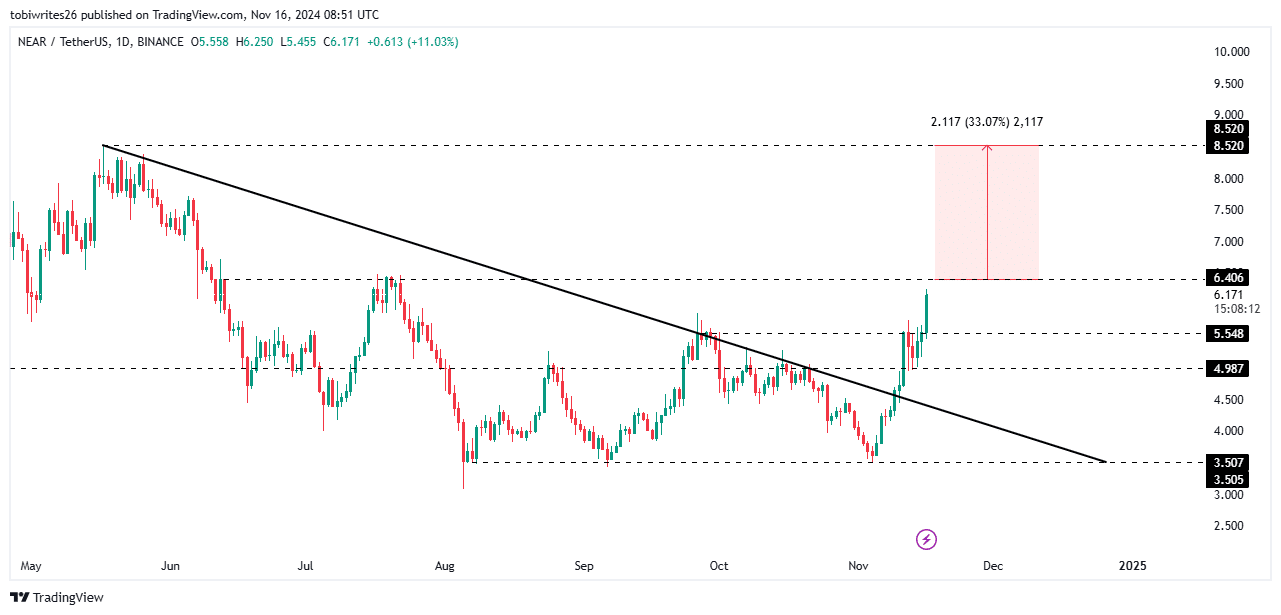

NEAR recently broke out of a descending trendline, driving its weekly gains, and extended this momentum after surpassing the resistance level at $5.548.

At press time, NEAR faced a crucial resistance at $6.406, which could stall its rally. This level likely holds significant selling pressure that may restrict price movement.

However, if bullish momentum continues, NEAR could break through this barrier and potentially surge by 33%, reaching $8.520.

If NEAR fails to breach $6.406, it may enter a consolidation phase, trading within the range of $6.406 to $5.548.

Despite this challenge, AMBCrypto identifies NEAR as predominantly bullish, supported by favorable market conditions.

Bullish momentum for NEAR

Technical indicators suggested that NEAR remained in a bullish state, potentially driving the asset higher.

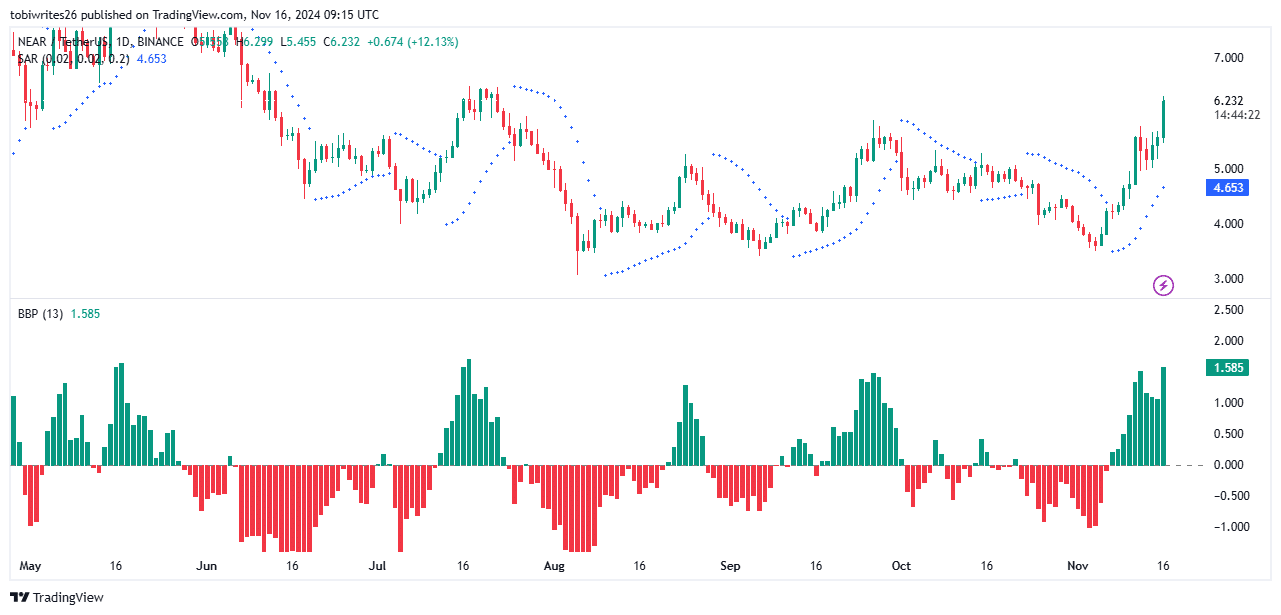

The Parabolic SAR (Stop and Reverse) is used to identify trend direction and reversal points by plotting dots above (bearish) or below (bullish) price movements.

At press time, the indicator had turned bullish, with dots forming below the price, signaling that momentum is building for continued upward movement.

Similarly, the Bull/Bear Power (BBP), which measures the balance between buyers (bulls) and sellers (bears), indicates a shift towards bullish market strength.

The formation of consecutive green bars on the chart reinforces this, showing that bulls are in control and suggesting the potential for a further rally in NEAR.

Multiple confluences support NEAR’s rally

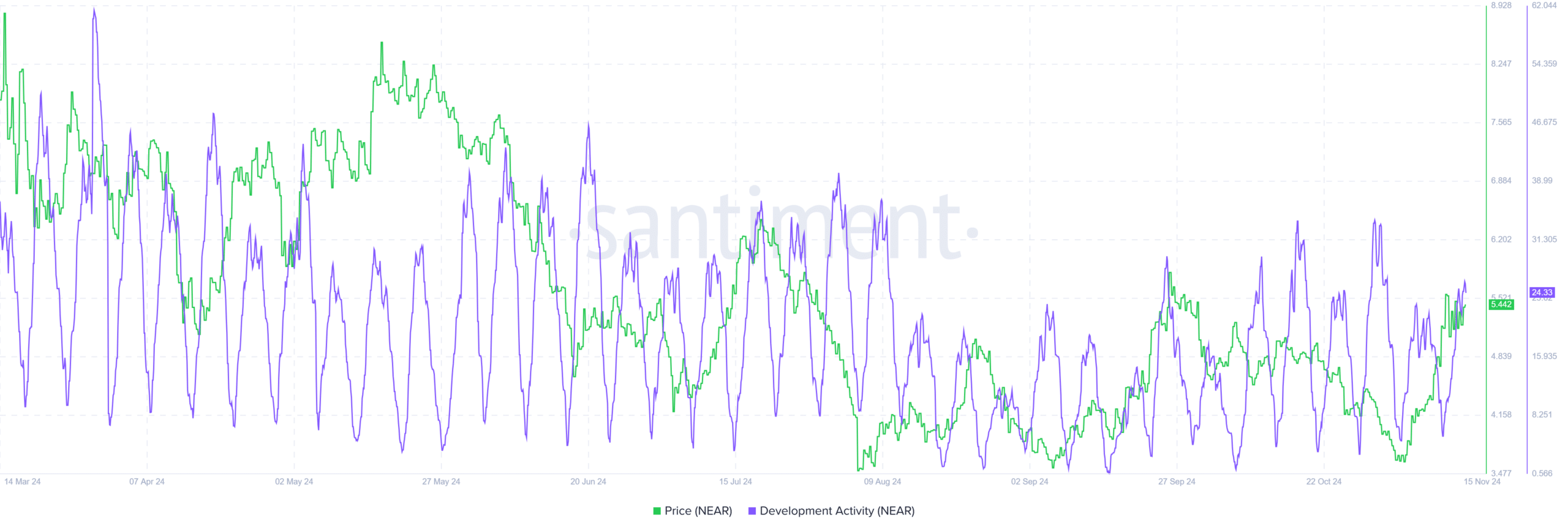

Development activity, which tracks ongoing improvements to NEAR Protocol’s ecosystem, has been on the rise, which is a positive momentum.

Historically, when development activity surges, the price often follows suit, and NEAR appears well-positioned for further gains.

In addition, according to Coinglass, Open Interest and the Long-to-Short ratio have been aligning in favor of NEAR, supporting its potential to break through resistance levels.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

NEAR’s Open Interest has risen by 20.58% in the last 24 hours, reaching a value of $398.10 million.

Meanwhile, the Long-to-Short ratio was favoring the bulls, standing at 1.0358, indicating that more long positions are being opened in the market at the time of writing.