- INJ’s recent $280K token burn and breakout above $28.44 have intensified bullish momentum, setting sights on $51.90.

- Balanced market sentiment and bullish technical indicators strengthen confidence in a rally continuation.

This week’s Injective [INJ] burn saw over 11,000 tokens, valued at more than $280K, permanently removed from circulation, amplifying Injective’s deflationary impact.

Consequently, this reduction in supply has ignited bullish sentiment among traders, especially as INJ’s price recently broke out of a long-standing descending channel.

Now, market participants are watching closely to see if this momentum can sustain, potentially pushing INJ toward higher targets.

Technical analysis: Breakout, key resistance, and bullish signals

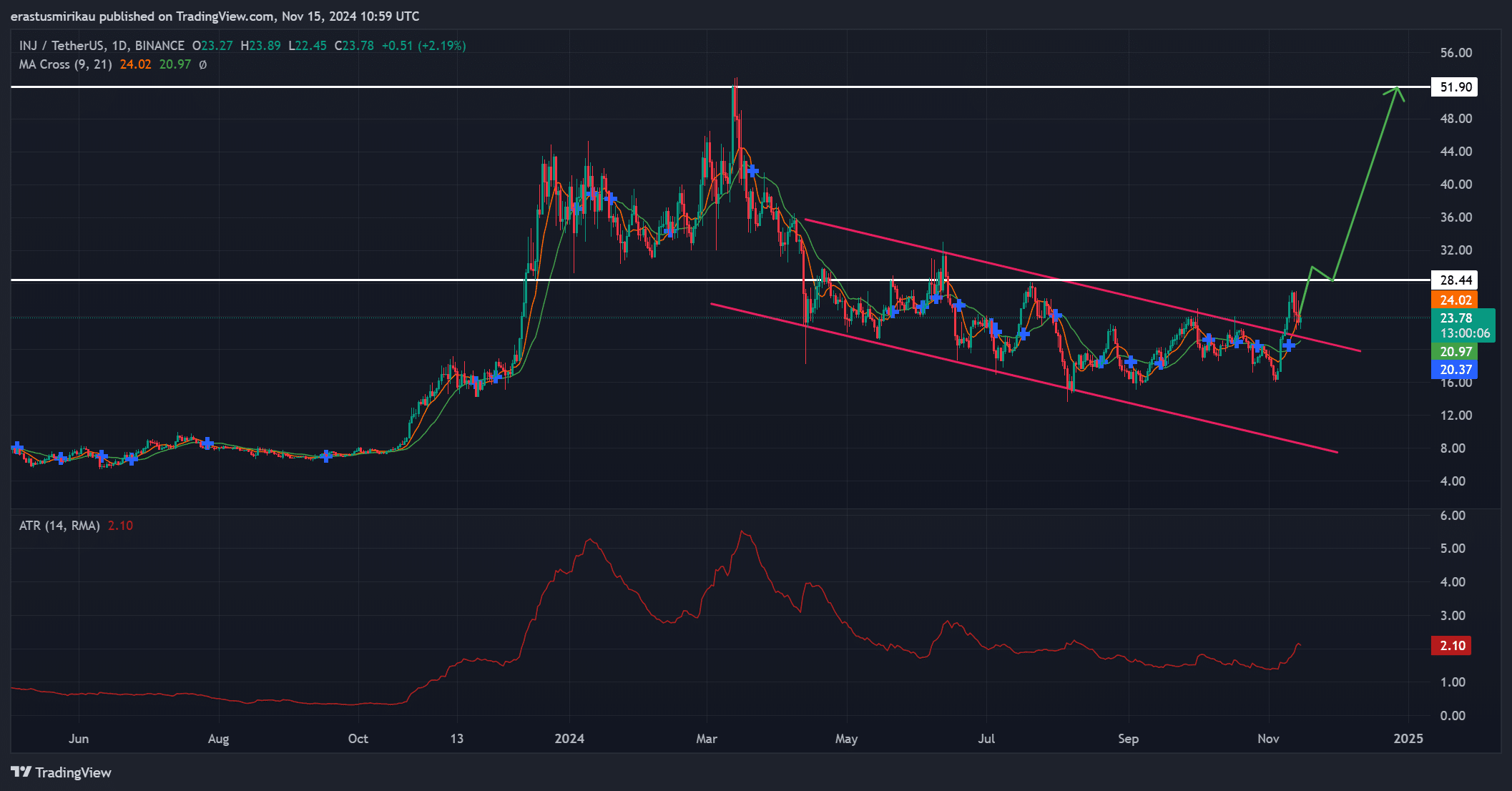

INJ has recently broken out of its descending channel, a level that previously capped any upward price movement for months.

This breakout indicates a shift in market sentiment, with buyers now reclaiming the $28.44 resistance level, a critical psychological and technical threshold. Holding above this level could propel INJ toward its next significant target at $51.90.

Furthermore, technical indicators are reinforcing this bullish narrative. The Average True Range (ATR) reveals increased volatility, suggesting heightened interest and potential for sharp price moves.

Additionally, the moving average crossover (MA 9 over MA 21) has provided a bullish signal, further strengthening confidence in INJ’s potential for continued gains.

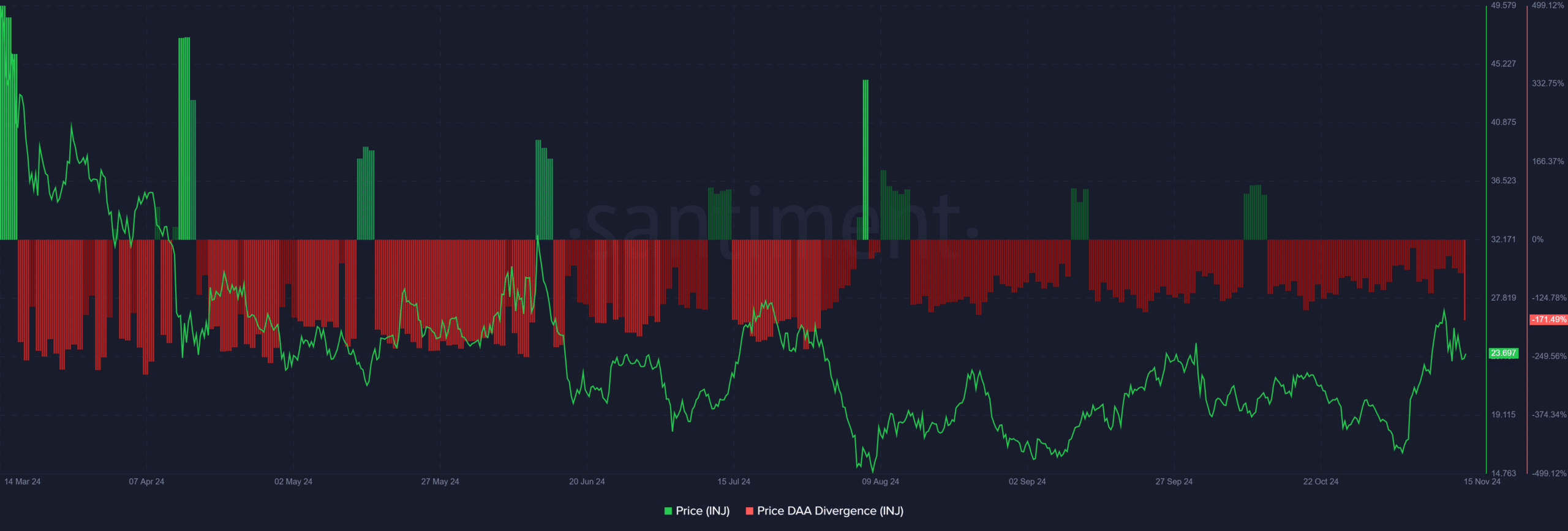

Price DAA divergence hints at caution

However, on-chain metrics reveal a subtle caution. The price-DAA (Daily Active Addresses) divergence currently shows a -171.49% difference, suggesting that price movement outpaces network activity.

While this could raise concerns, the strong technical setup and ongoing token burn may counterbalance this divergence. Therefore, if buying momentum continues, this divergence may hold less weight for bullish traders.

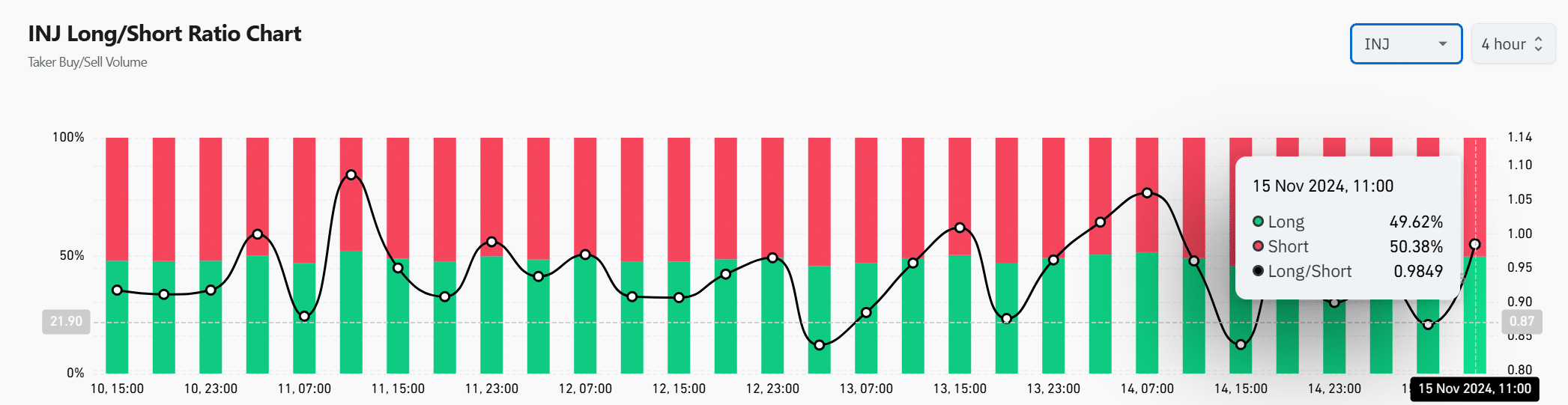

Market sentiment remains balanced but leans bullish

The INJ long/short ratio, nearly balanced with shorts at 50.38% and longs at 49.62%, reflects a cautiously optimistic sentiment. Traders are aware of the recent breakout but are still cautious, waiting for confirmation that the $28.44 level can hold as new support.

However, as confidence grows, this sentiment may shift more decisively in favor of the bulls, particularly if INJ sustains levels above $28.44.

Read Injective’s [INJ] Price Prediction 2024–2025

With continuous token burns, a key breakout above $28.44, and supporting technical indicators, INJ appears poised for a rally.

Therefore, if bullish momentum persists, the $51.90 target becomes a realistic and attainable goal in the coming months.