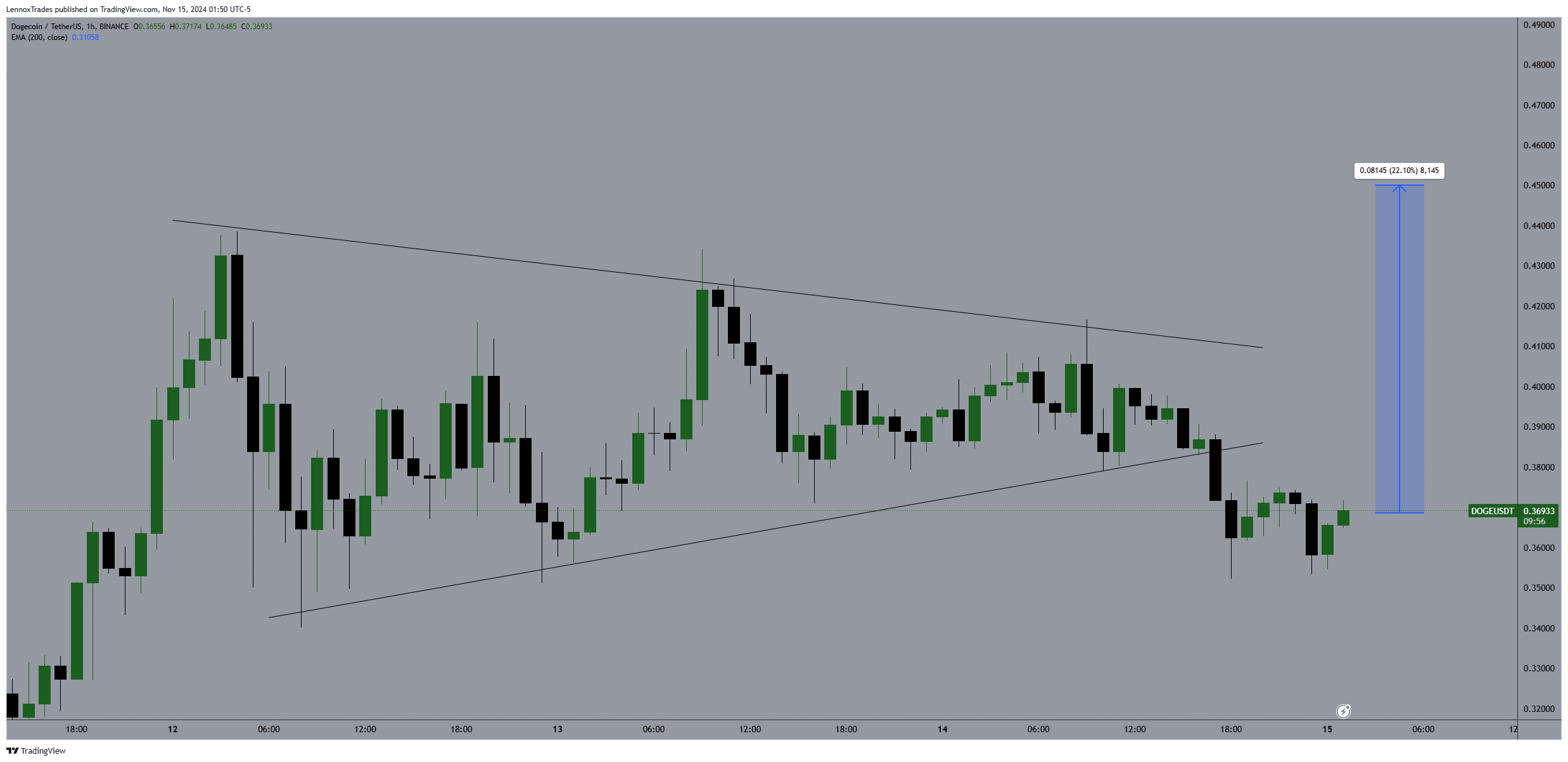

- Dogecoin breaks below wedge pattern, but there’s a potential double bottom at $0.38 mark.

- DOGE’s social sentiment rises as funding rates spike to new peaks.

Dogecoin [DOGE] recently showed its potential for a rally as its price moved within a defined price pocket between $0.42 and $0.38.

Observing the chart, DOGE broke to the $0.38 mark, hinting at a possible double bottom formation that could trigger 22% price increase.

This pattern suggested a pivotal moment; if DOGE manages to break and sustain price above the $0.42 level, it could rally past the 22% increase from its current price. On the other hand, failing to reclaim this level could extend the downward trend.

For traders looking for a more conservative approach, waiting for a clear break above the $0.42 resistance might be the safer bet.

Such a breakout would confirm a strong bullish momentum, likely initiating a sustained upward trajectory. This critical juncture requires vigilant observation as it could likely determine DOGE’s short-term market direction.

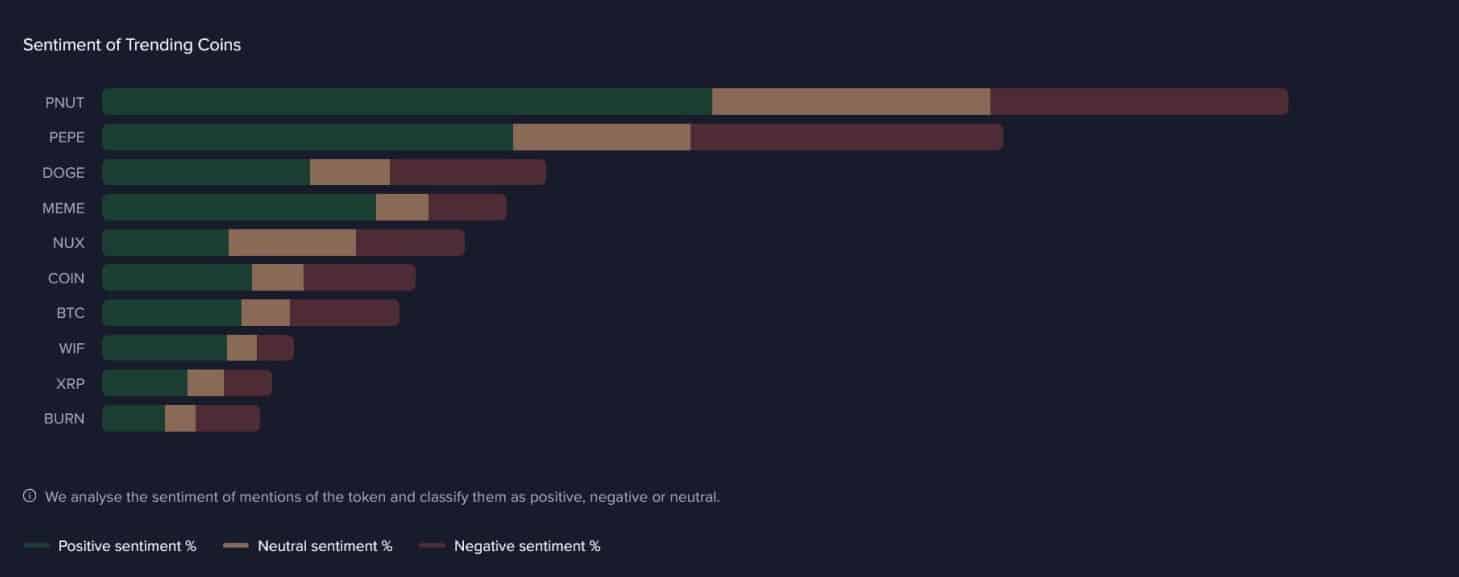

Social dominance and sentiment

DOGE continued to solidify its position as a dominant memecoin within the social media sphere, ranking third on the list of top trending tokens.

This spotlight on Dogecoin highlighted its ongoing popularity and potential for a rally past 22% gains if price holds above $0.42 driven by speculative interest, during this historic bull rally in the crypto markets.

Among meme coins, Dogecoin, along with PNUT and PEPE, led the surge in social media discussions, underscoring DOGE’s strong presence and influence.

As Bitcoin finds itself below several memecoins at seventh in discussion rates, it illustrated the shift in investor focus towards more speculative assets.

DOGE’s crowd enthusiasm suggested a continued bullish sentiment. The Smart Money was bullish too as per Market Prophit on X. This could lead to increased trading volumes and possibly a pump as more investors get drawn to these high-discussion memes.

This dynamic could bolster Dogecoin’s market position further, attracting both seasoned traders and newcomers aiming for quick gains in a vibrant market environment.

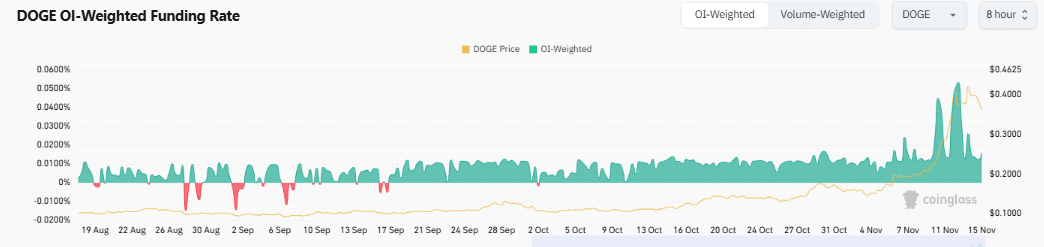

Open interests and funding rates

Dogecoin’s OI-weighted funding rate has generally hovered around 0.0158% recently, showing a balance between buyer and seller sentiment.

Sharp spikes in the funding rate, both upward and downward, indicated brief periods where longs or shorts faced higher costs.

Recently, the funding rate experienced a peak concurrent with a noticeable increase in DOGE’s price especially after hitting above $0.42.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

This peak indicated heightened activity and could suggest increased speculative interest or leverage in the market.

If the high funding rate continues, it might suggest a looming price correction from trader over-leverage, affecting DOGE’s price stability. Conversely, a normalization of funding rates close to zero could stabilize price movements leading to a surge past 22%.