- A sell signal appeared on BTC’s daily chart, hinting at a correction.

- Bitcoin was testing key support, and the NVT ratio indicated that BTC was undervalued.

After successfully crossing the $91k mark, Bitcoin [BTC] faced a correction, pushing the king coin down under $90k again. In fact, the latest data already flagged the possibility of a correction happening. Does this mean BTC was poised for more price drops?

Bitcoin’s bull rally halts

Over the past few weeks, Bitcoin has smashed multiple resistance levels. This sparked excitement in the community about BTC next touching $100k.

However, soon after reaching $91k, a sell signal appeared. Ali, a popular crypto analyst, recently posted a tweet revealing that Bitcoin’s TD sequential flashed a sell signal.

BTC’s rally did halt after the signal appeared, as its value declined by over 3% in the past 24 hours. At the time of writing, BTC was trading under $90k at $87,524.10.

Apart from this, AMBCrypto also reported earlier that the crypto market was in an “extreme greed” phase. This was similar to the March surge when Bitcoin hit $73k before crashing to $67k again.

At press time too, the fear and greed index had a value of 80, suggesting a similar greedy sentiment in the market.

But investors’ should remain patient. The Bitcoin Rainbow Chart pointed out that the king coin’s price was in the “HODL” position, meaning that it might just be right for investors to continue holding their BTC.

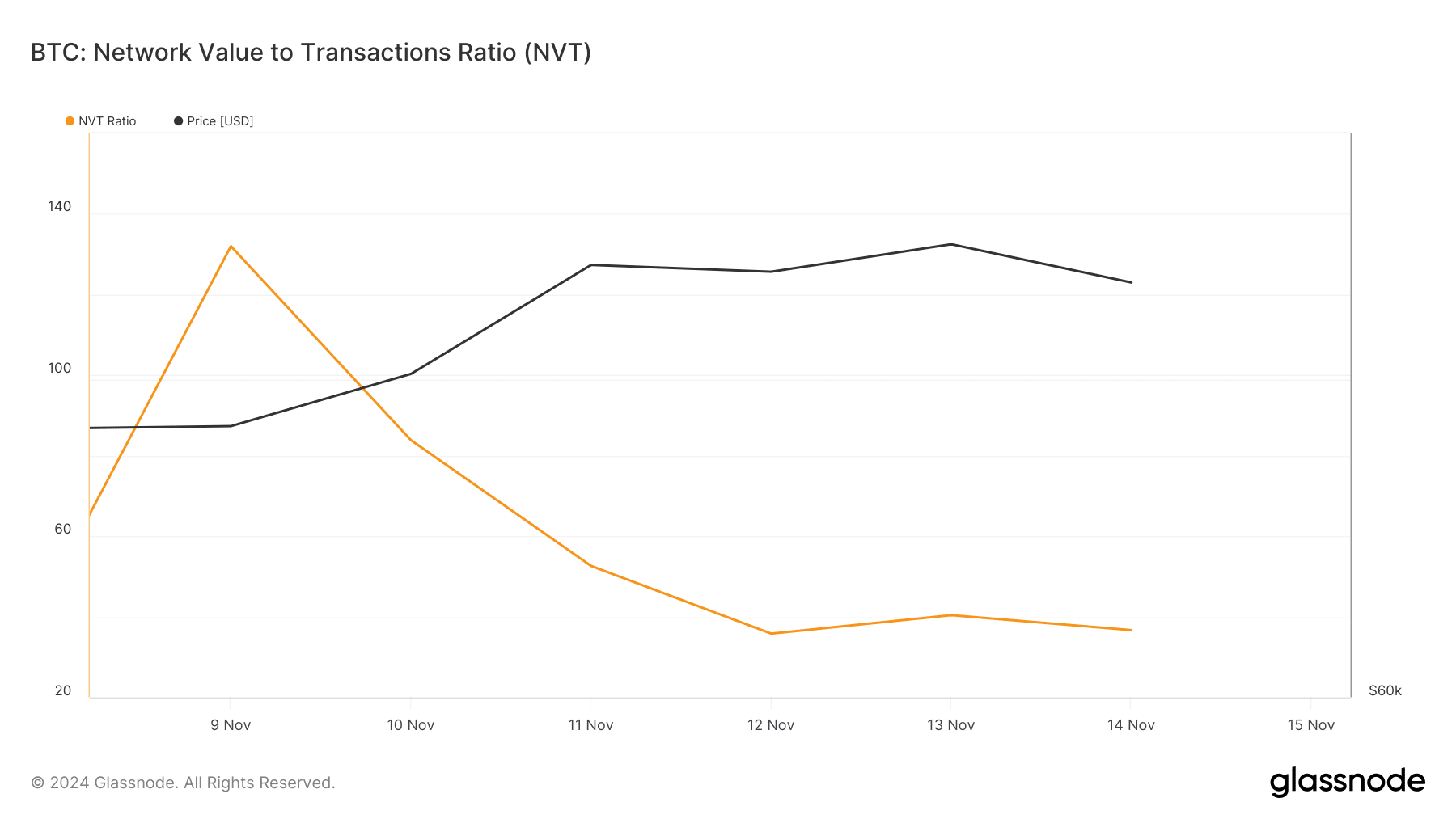

Glassnode’s data revealed that despite the last major price pump, Bitcoin’s NVT ratio registered a massive dip last week. Whenever the metric drops, it means that an asset is undervalued, hinting at a price rise in the coming days.

Another good news for BTC was its declining exchange reserve in the past 24 hours. This indicated that investors did not panic sell, which could prevent a steep price drop in the near term.

Checking BTC’s nearest support

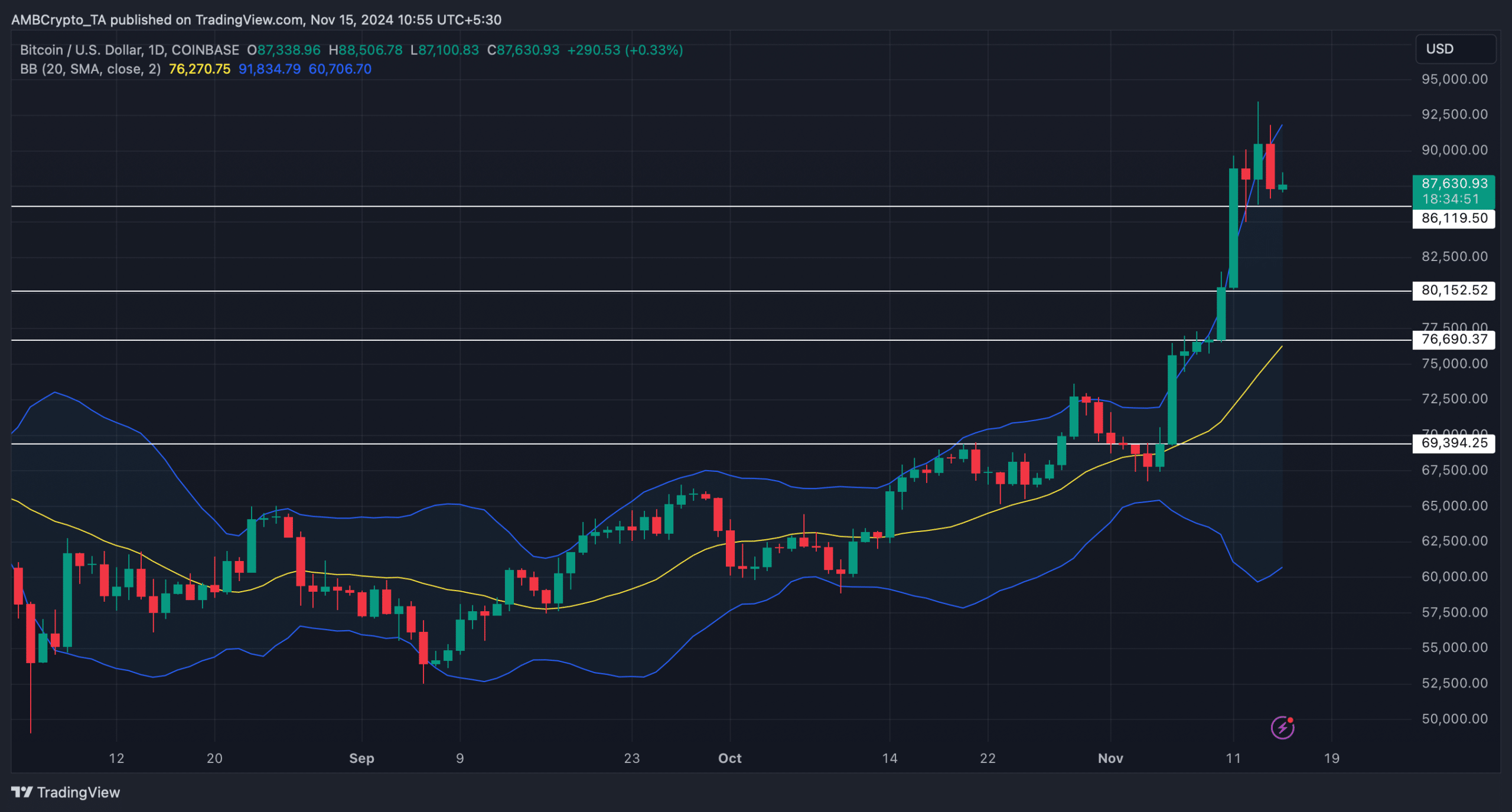

Checking Bitcoin’s daily chart is often a good option to look for immediate support and resistance zones when prices remain volatile.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

BTC’s price had touched the upper limit of the Bollinger Bands, and at the time of writing, it was testing its support near $86k. A successful test of the support could kickstart yet another bull rally.

Nonetheless, if Bitcoin fails to do so and slips under the support, it could drop to the range of $76k-$80k. A further price plummet from that range could once again push BTC down to near the $70k mark.