- A confirmed bullish pennant breakout may position BNB for more gains

- Technical indicators and rising derivatives activity supported the likelihood of sustained bullish momentum

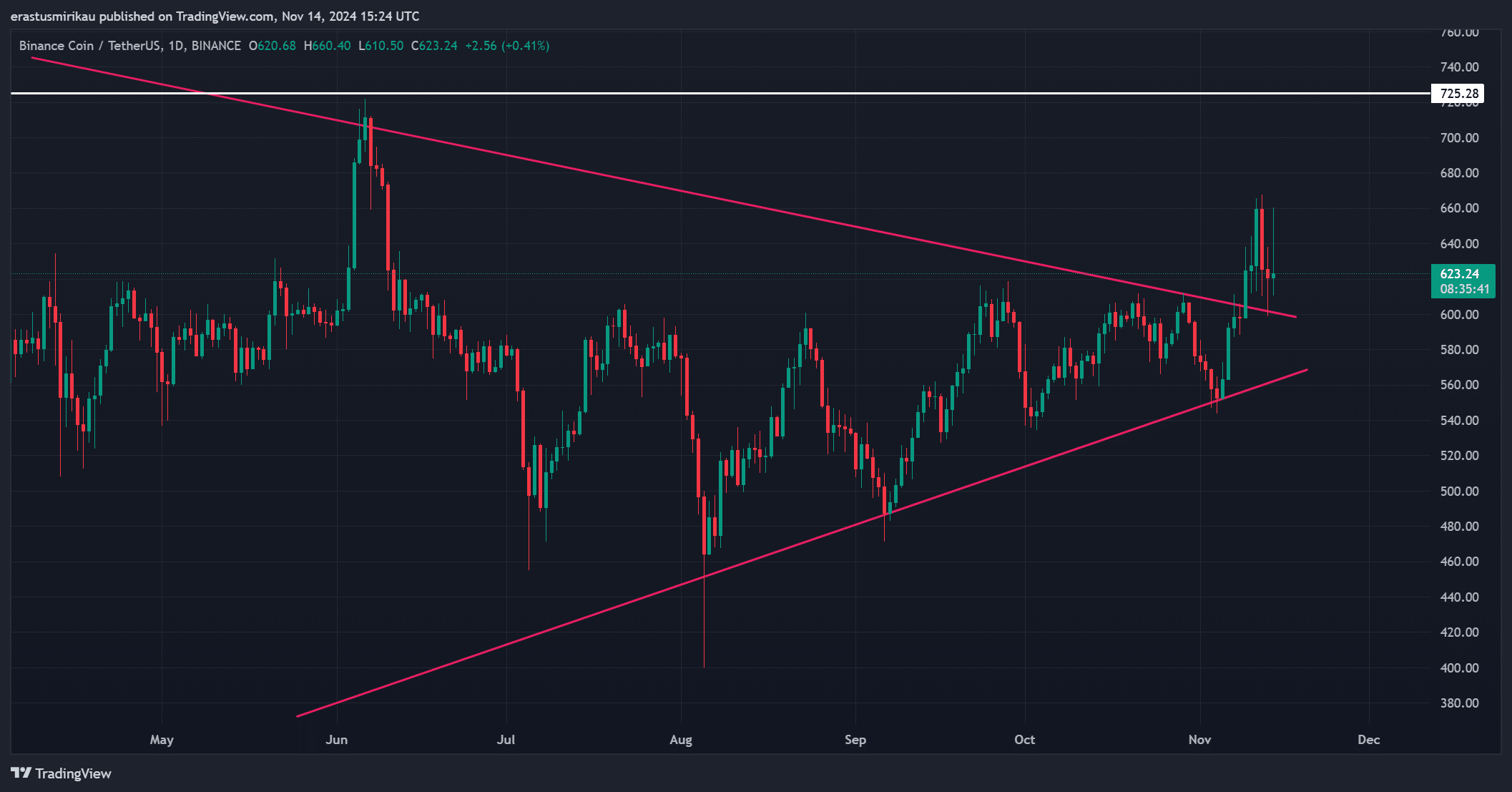

Binance Coin [BNB] has caught the attention of investors with a confirmed bullish pennant breakout, highlighting the potential for a significant rally. At press time, BNB was trading at $624.51, following a minor dip of 0.98% in 24 hours.

With BNB now just 12.19% below its all-time high of $720.67 from June 2024, this breakout raises the question – Can BNB sustain this momentum and hit its midterm target of $725?

Further upside potential?

The altcoin’s chart analysis revealed a robust bullish pennant breakout, pointing to a potential upward trajectory. This breakout seemed to lift BNB above a key descending trendline, setting the stage for an ambitious price target of $725 in the midterm.

If Binance Coin maintains this momentum and achieves its goals, it could establish a strong bullish foundation for further upward movement, with a longer-term target being $1,000.

However, critical levels around $640 may still pose some challenges in the short term, while the support at $600 could provide a cushion in case of minor pullbacks.

Technical indicators strengthen BNB’s outlook

Several technical indicators reinforced the bullish case for BNB. The Relative Strength Index (RSI) hovered around 58.08, indicating favorable conditions for growth without the risk of an overbought scenario.

Additionally, the recent Moving Average (MA) cross between the 9-day and 21-day averages around $618 was another strong bullish signal – A sign of sustained price momentum. Therefore, the combination of a positive RSI and MA cross aligned well with the pennant breakout, increasing the likelihood of BNB hitting its target.

Increasing interest in BNB

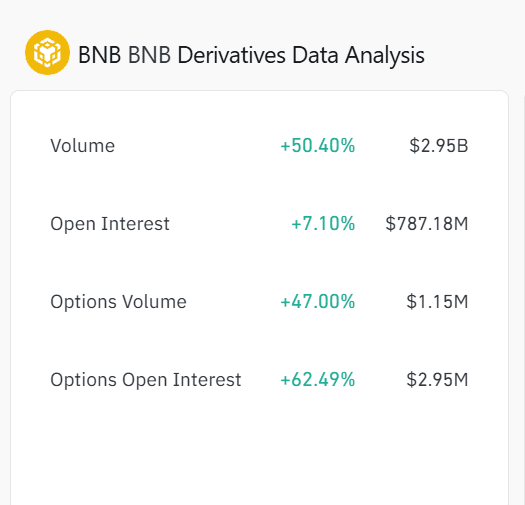

Derivatives data further highlighted its bullish potential. Volume surged by 50.40% to $2.95 billion, while Open Interest rose by 7.10%, totaling $787.18 million.

Additionally, the Options volume was up by 47.00%, with Options Open Interest registering gains of 62.49%. These hikes indicate heightened confidence from traders, who may be positioning themselves for a potential rally, one likely driven by the recent technical breakout.

BNB’s social dominance declines despite positive outlook

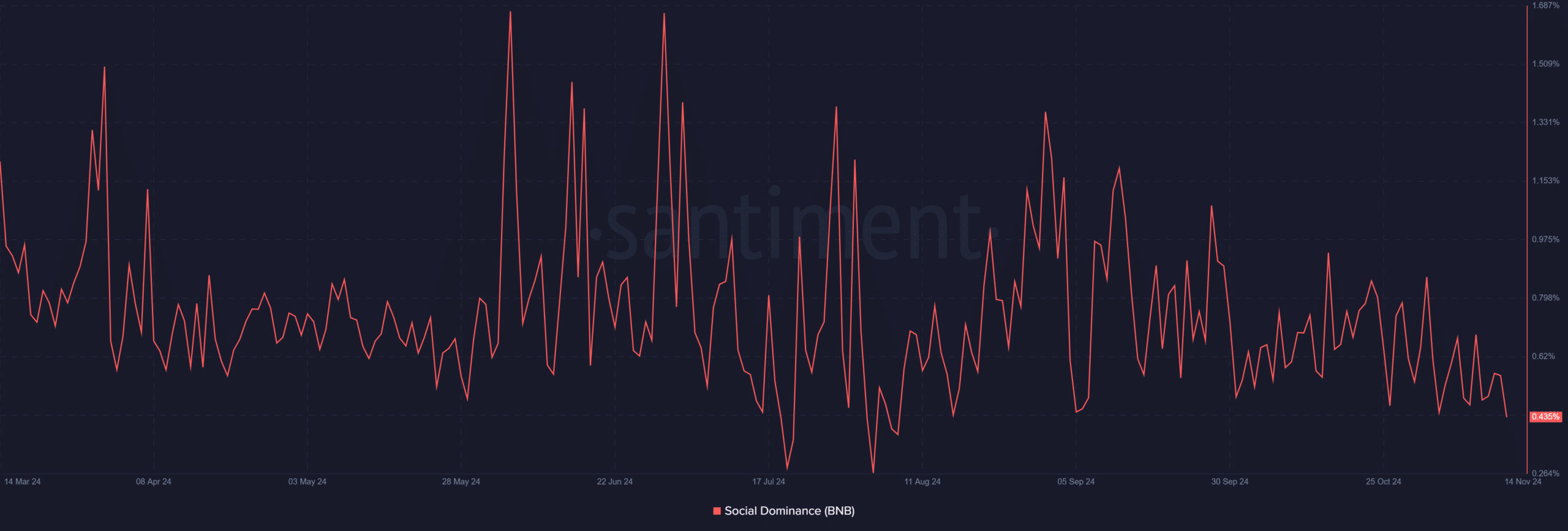

Interestingly, its social dominance dropped from 0.562% to 0.435%, suggesting a fall in social media attention. This decline may reflect waning interest among retail traders, even as technical indicators and derivatives data remain strong.

However, this shift could also mean BNB has room to attract renewed interest. Especially if it hits the $725 target and builds momentum.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB poised to reach $725 target and beyond

With a confirmed bullish breakout, positive technical indicators, and increasing derivatives activity, BNB appeared set to reach its midterm target of $725 at press time.

Achieving this level could further bolster its bullish outlook and set the stage for a longer-term rally. Simply said, BNB may be ready to capture fresh gains, provided it sustains momentum and attracts renewed retail interest.