- Whales accumulate over 100k Bitcoin in a week.

- Metrics suggested potential bullish breakout as selling pressure subsided.

Everything seems to be buzzing in the cryptocurrency market due to recent developments in Bitcoin [BTC].

Whales, technical patterns, and on-chain metrics all combined to indicate a potential change in the price trajectory of BTC.

Is this the moment that will lead to the next big rally?

The calm before the storm?

Bitcoin has witnessed its fair share of ups and downs these weeks, moving between buying and selling pressures.

BTC recently started to stabilize after a slight dip, signaling that the market might be positioning itself for a significant move.

This could be the setup for a possible breakout, with large investors heightened interest.

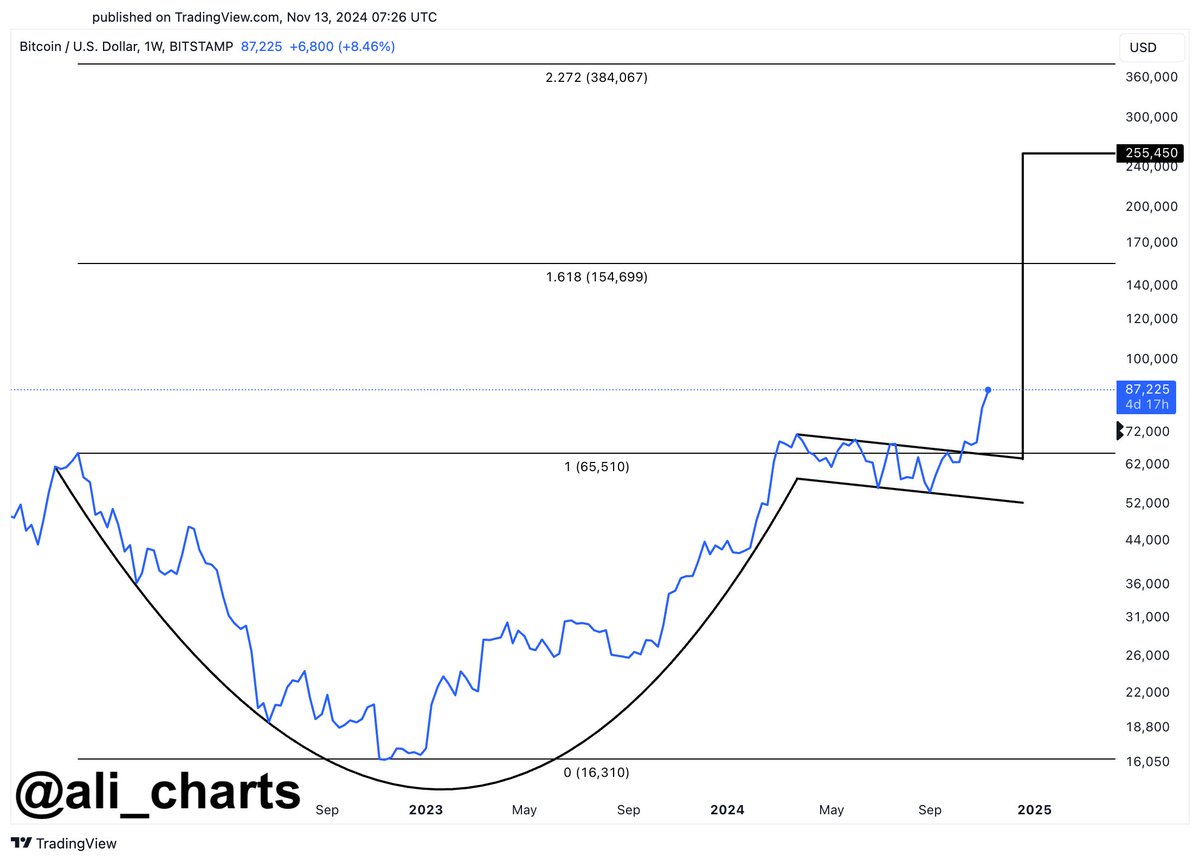

According to a recent tweet from analyst Ali Martinez, Bitcoin’s recent price action pointed to the formation of a potential cup-and-handle pattern, known for its bullish implications.

If this pattern holds, BTC could aim for a target price as high as $255K.

BTC whales make moves

On-chain data further bolstered this outlook, showcasing various supportive indicators. According to the same analyst, whales have bought over 100K BTC in the past week, valued at around $8.60 billion.

Such large-scale BTC buying typically correlates with upward price movements, as whales often set the pace for market sentiment.

Profit-taking or diamond hands?

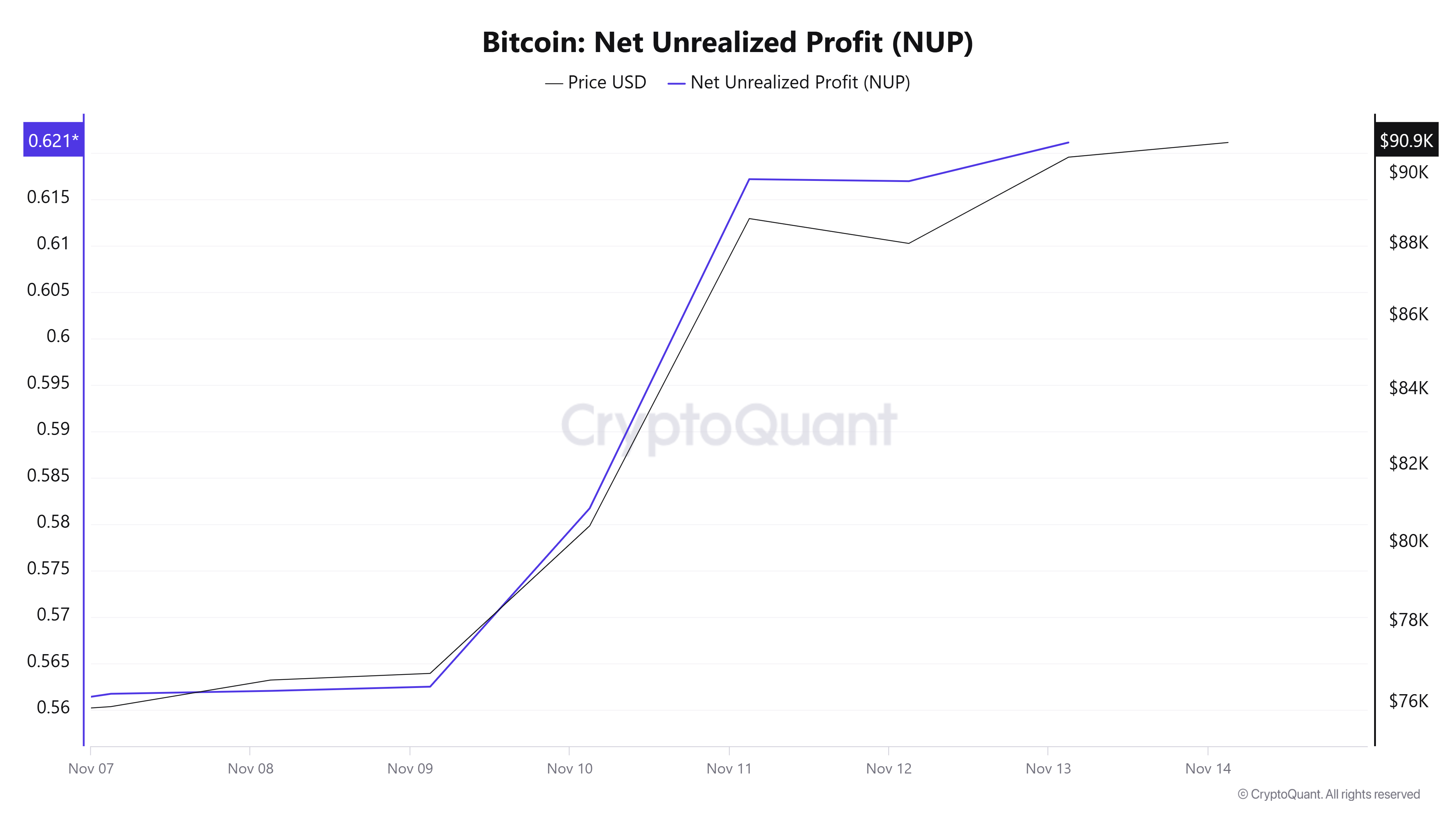

AMBCrypto analysis of Santiment revealed that net unrealized profits climbed between the 9th and the 11th of November, indicating a phase of increased selling pressure.

However, this has leveled out since then, suggesting less selling and a more stable holding pattern. The change may pave the way for further BTC’s potential growth.

What does the MVRV have in store?

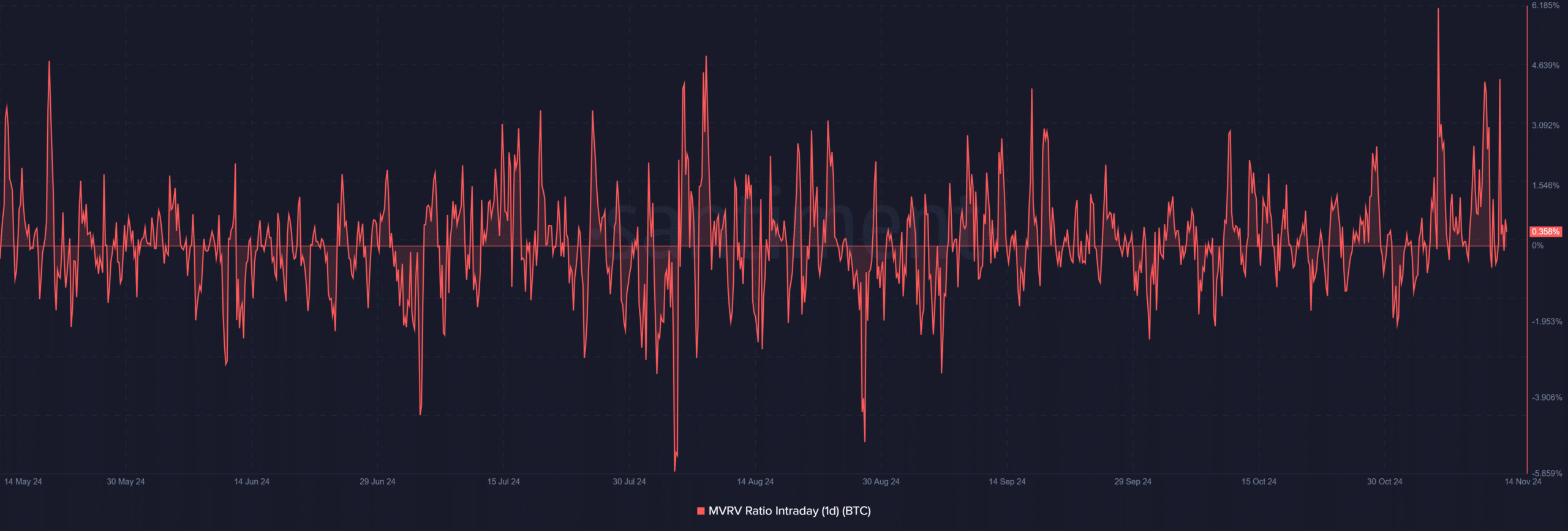

Adding to the aforementioned positive sentiments, the BTC Market Value to Realized Value (MVRV) ratio was at 0.36%, positioning BTC just above its realized price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This suggested that Bitcoin is not overbought and retains potential for upward movement.

Historically, similar MVRV levels have often preceded price rallies, signaling a promising Bitcoin setup for continued growth.