- SHIB faces critical resistance near $0.00002700, with technical indicators hinting at sustained bullish momentum.

- Rising on-chain activity and increased open interest underscore strong market optimism and community support.

Shiba Inu [SHIB] has experienced a remarkable 3,679% surge in its burn rate within 24 hours, sharply reducing its circulating supply and boosting its price.

Trading at $0.00002612, up 8.82% at press time, SHIB’s rally has captured market attention. However, fluctuating market dynamics leave investors wondering if this momentum can be sustained.

Key resistance levels and bullish indicators for SHIB

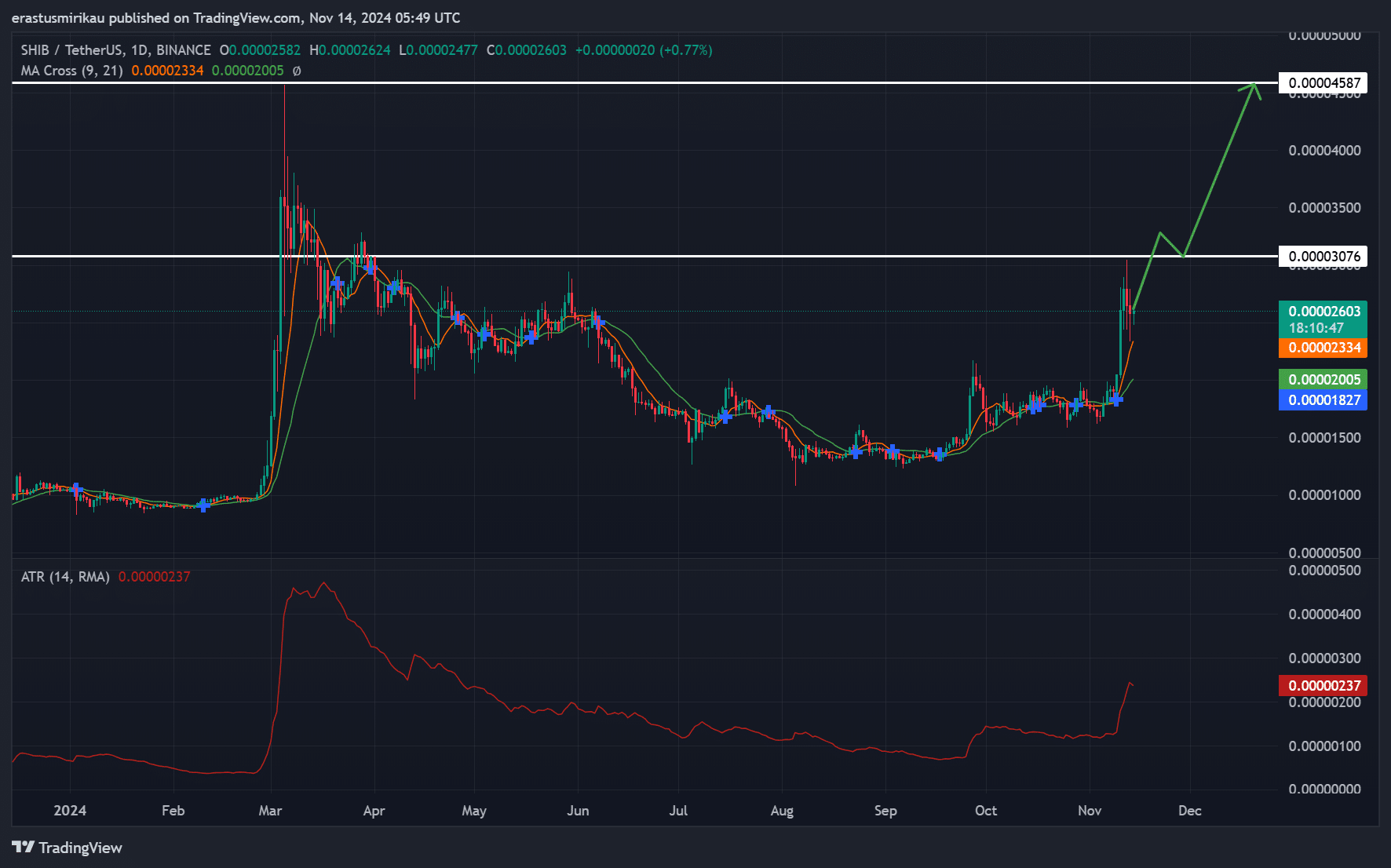

SHIB’s price surge has brought it close to the critical resistance level at $0.00003076. This level stands as a major hurdle; however, if SHIB breaks through it, a path to the next target at $0.00004587 may open up.

Clearing this resistance could signal a strong bullish continuation, drawing in more buying interest.

Conversely, failure to surpass this threshold may result in a pullback, possibly leading to consolidation around lower support levels. Traders are watching this closely, as the outcome here could shape SHIB’s trajectory in the near term.

The Average True Range (ATR), now at 0.00000237, indicates a rise in volatility, reflecting the heightened trading activity surrounding SHIB. This increased volatility suggests that substantial price movements could continue, especially as SHIB approaches significant resistance.

Consequently, traders should brace for potential fluctuations as market participants respond to SHIB’s next moves.

Additionally, Shiba Inu’s moving averages have recently experienced a bullish crossover, where the short-term 9-day moving average has moved above the 21-day moving average.

This crossover is a positive technical indicator, often seen as a precursor to continued price growth. Therefore, this setup reinforces the case for SHIB’s potential rally if it manages to maintain its current momentum.

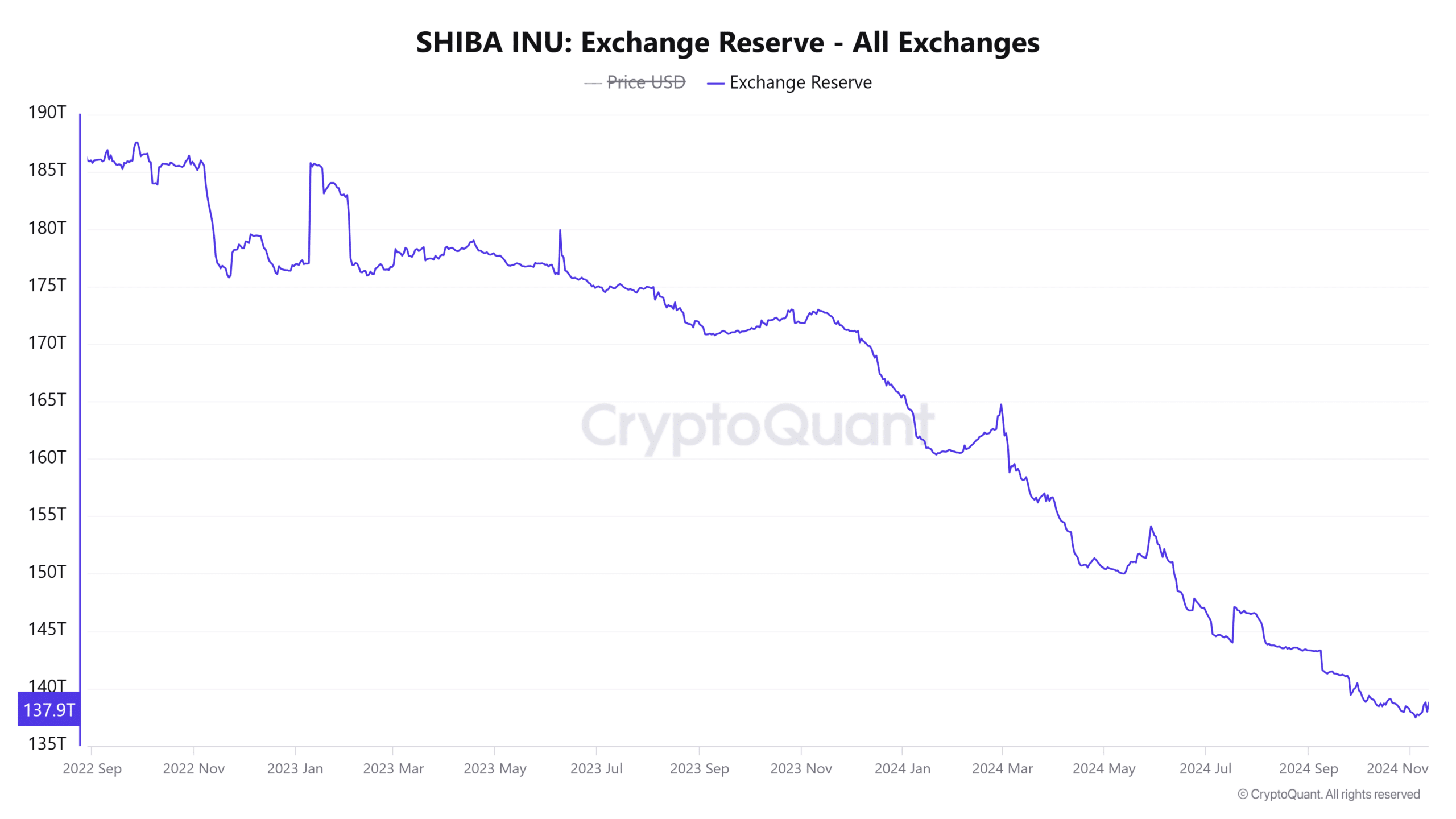

SHIB exchange reserves hint at potential selling pressure

The exchange reserve metric stands at 138.5537 trillion, reflecting a minor 0.04% uptick in the past 24 hours. This slight increase may seem insignificant, but it could signal an underlying selling pressure as more SHIB tokens are being held on exchanges.

Typically, higher reserves indicate that investors are preparing for liquidity, which might align with profit-taking. Therefore, if Shiba Inu fails to maintain its current levels, this selling pressure could intensify, hindering its price growth.

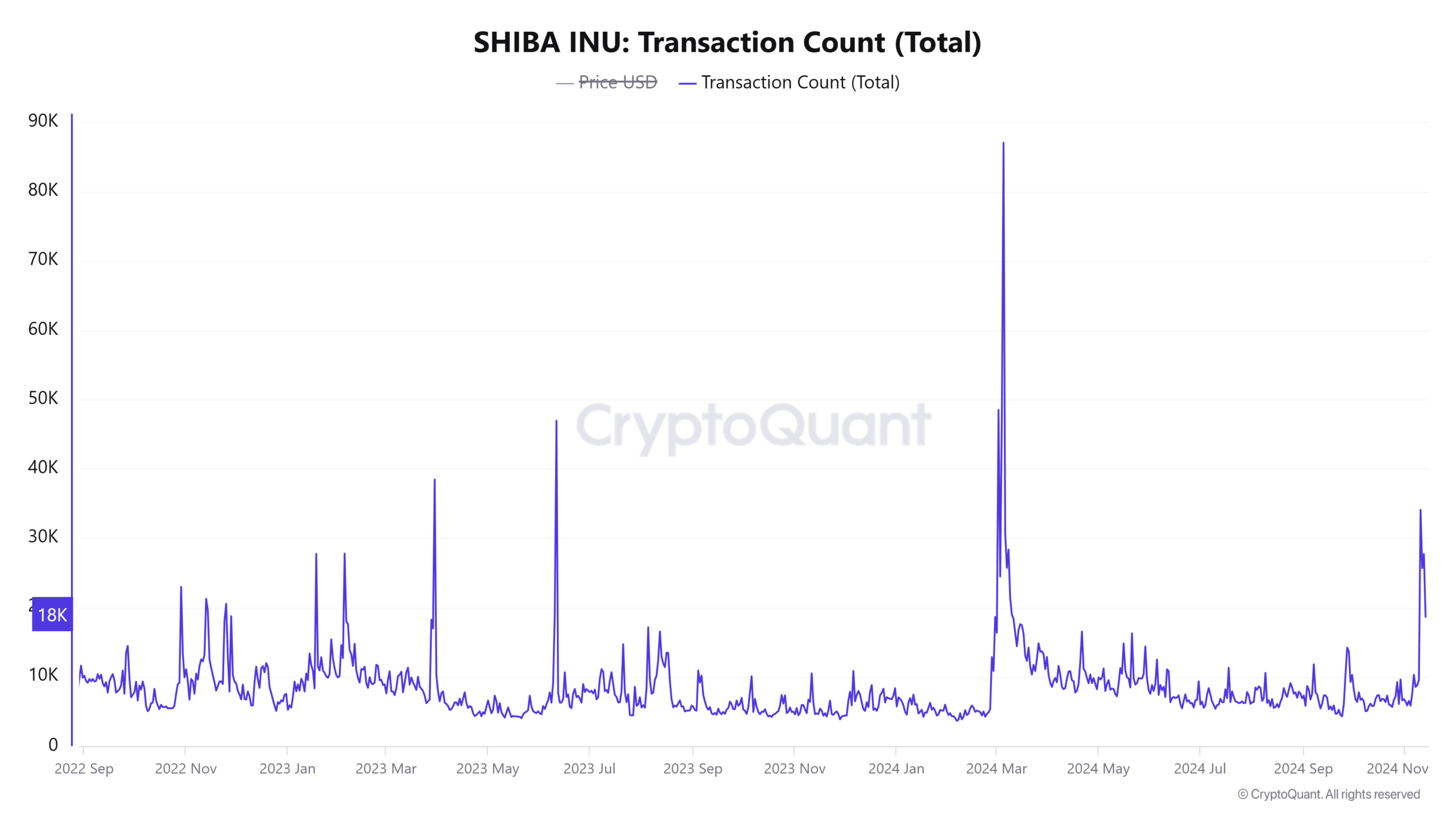

Growing on-chain activity supports momentum

Interestingly, Shiba Inu’s active addresses have risen by 0.81%, suggesting increasing network activity and heightened interest from the community. This increase in engagement is further supported by a 0.74% rise in transaction count to 18.82K, highlighting the active trading and transfer of SHIB tokens.

Such on-chain metrics often reflect robust community support, which is crucial for sustaining SHIB’s price in the long run.

Market sentiment and open interest signal optimism

The 14.38% surge in open interest, now at $94.83M, underscores growing market optimism. High open interest indicates that traders are increasingly betting on Shiba Inu’s future performance, likely speculating on continued price growth.

However, increased open interest also brings heightened risk, as leveraged positions can amplify both gains and losses. Therefore, while optimism remains high, caution is advisable due to the potential for increased volatility.

Read Shiba Inu Price Prediction 2024-25

Can SHIB maintain its upward trend?

While Shiba Inu’s recent price surge and burn rate boost are promising, its future trajectory depends on breaking key resistance levels and managing exchange reserve dynamics.

The rise in active addresses and open interest suggests a positive outlook, but with volatility expected, SHIB’s ability to sustain its rally will hinge on strong community engagement and technical performance in the coming days.