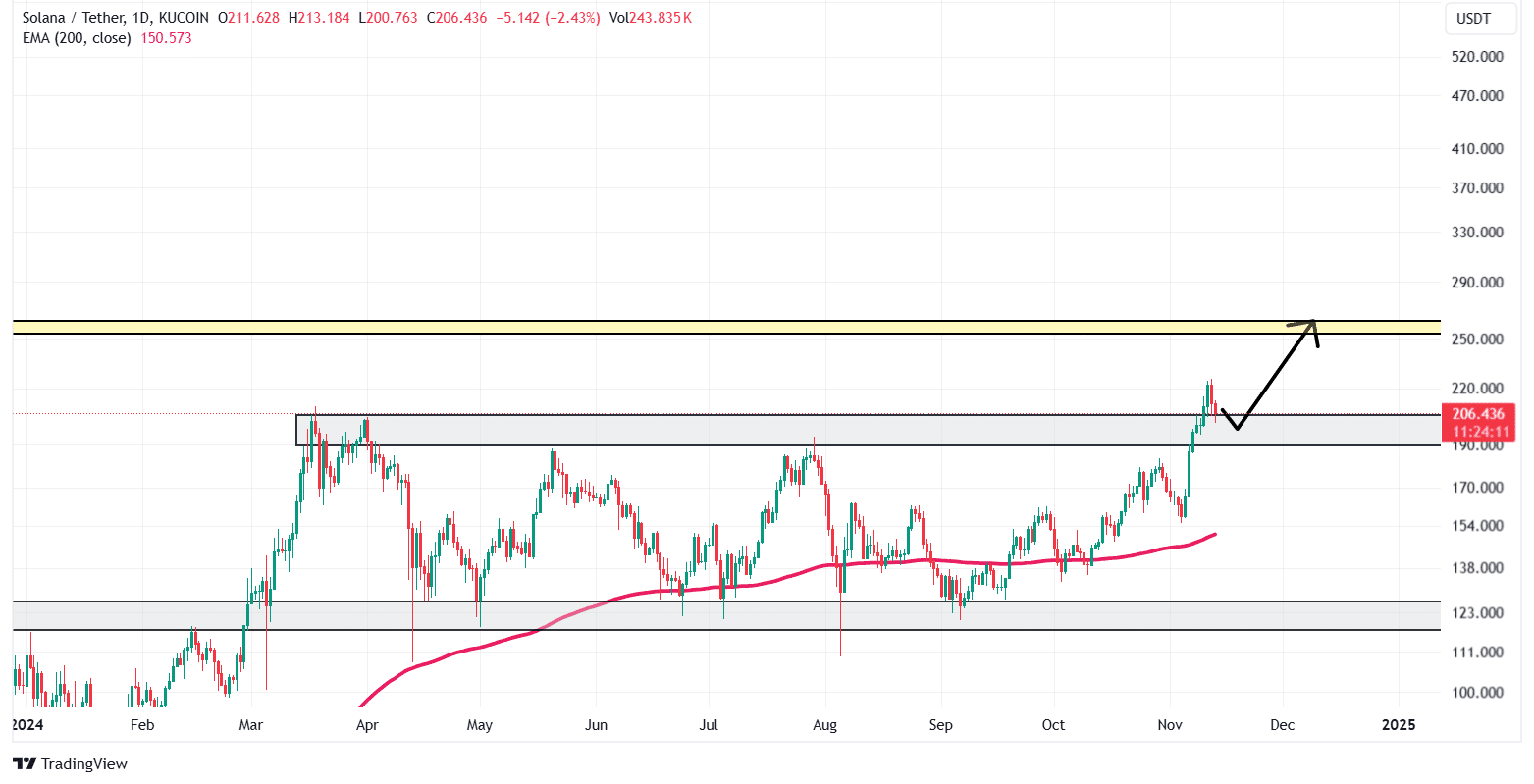

- Following the confirmation of the breakout, Solana could potentially rise by 25% to hit the $260 level.

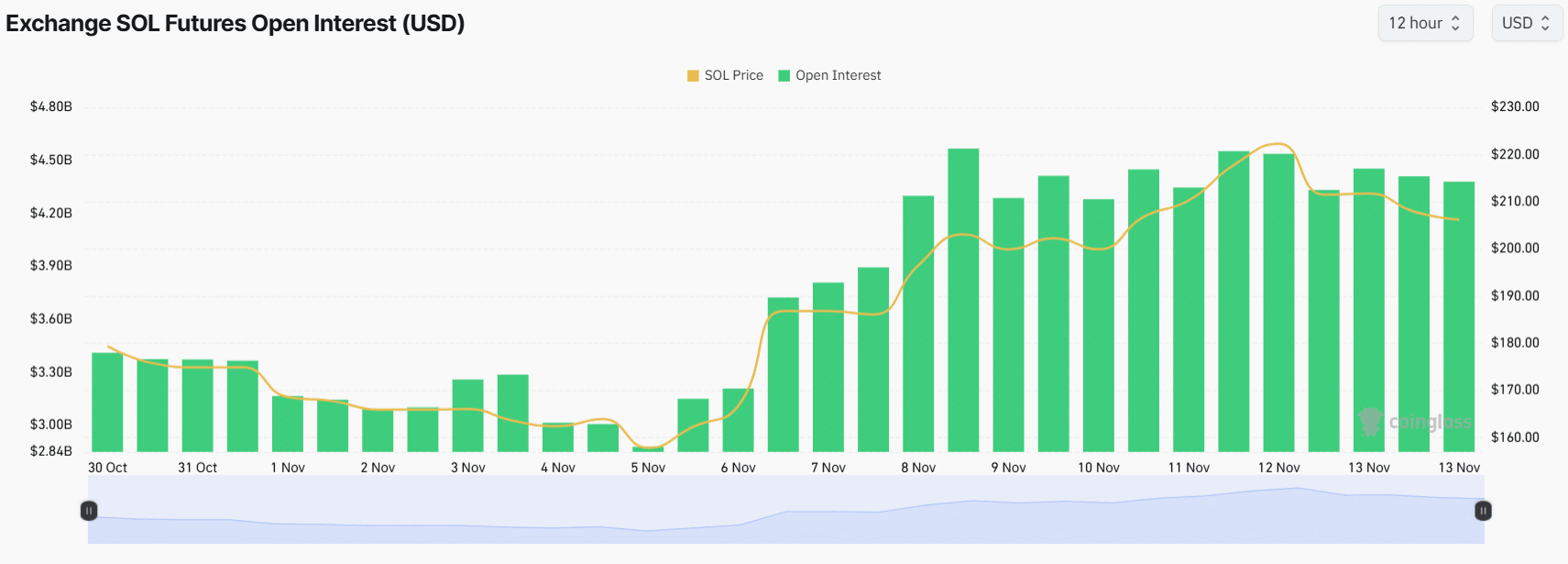

- SOL’s Open Interest has surged aggressively, indicating increased participation from traders.

The overall cryptocurrency market appeared to be experiencing a price correction over the last 24 hours.

Amidst this, Solana [SOL], the fourth-largest cryptocurrency, has successfully retested its breakout level, and there is a strong possibility of upside momentum in the coming days.

The potential reasons behind this bullish speculation are positive price action, bullish on-chain metrics, and heightened participation from traders and whales.

Solana technical analysis

Solana’s price was at a crucial support level of $200 at press time. Based on recent price action and historical momentum, there is a strong possibility that the asset could soar by 25% to reach the $260 level soon.

At press time, SOL was trading above the 200 Exponential Moving Average (EMA) on the daily time frame.

Meanwhile, its Relative Strength Index (RSI) hinted at a potential upside rally, with its value near the oversold territory.

Bullish on-chain metrics

In addition to SOL’s positive outlook, on-chain metrics further support the asset’s bullish behavior. According to the on-chain analytics firm Coinglass, SOL’s Open Interest has seen an aggressive rise.

Over the past few hours, the Open Interest (OI) has increased by 3.5%, and in the past four hours, it has risen by 5.2%. This indicated notable trader participation in the asset as it is poised for upside momentum.

Major liquidation levels

At press time, the major liquidation levels were at $199.5 on the lower side and $210.8 on the upper side, with traders being over-leveraged at these points, according to Coinglass data.

If the sentiment remains unchanged and the price rises to $210.8, nearly $52.7 million worth of short positions will be liquidated.

Read Solana’s [SOL] Price Prediction 2024–2025

Conversely, if the sentiment shifts and the price drops to $199.5, approximately $110 million worth of long positions will be liquidated.

So, it appears that bulls are currently dominating the asset and could support it in its upcoming rally over the next few days.