- POL declined by over 5% in the last 24 hours.

- Network growth has also continued to drop.

Polygon [POL] holders faced challenging times, as on-chain data revealed that 81.60% were ‘out of the money’ at press time.

This metric, which tracks the profitability of wallet addresses based on their token purchase prices relative to the current market price, suggests that most holders are at a loss.

With POL struggling to regain bullish momentum amid bearish market conditions, this data raises the question: is this a sign of capitulation or the groundwork for a recovery?

Polygon’s price struggles

The ‘In/Out of the Money’ chart from IntoTheBlock painted a stark picture. The dominance of red zones indicated that most holders were underwater, with only a small fraction in profit.

This imbalance correlated with Polygon’s extended price decline throughout 2024, reflecting broader market trends as well as specific challenges facing the Polygon ecosystem.

Periods like these often see increased selling pressure as frustrated holders exit their positions, exacerbating the downtrend.

However, they can also mark a market bottom if long-term investors step in, attracted by the prospect of discounted prices.

Historically, such high percentages of loss-making holders have sometimes been a precursor to recovery phases.

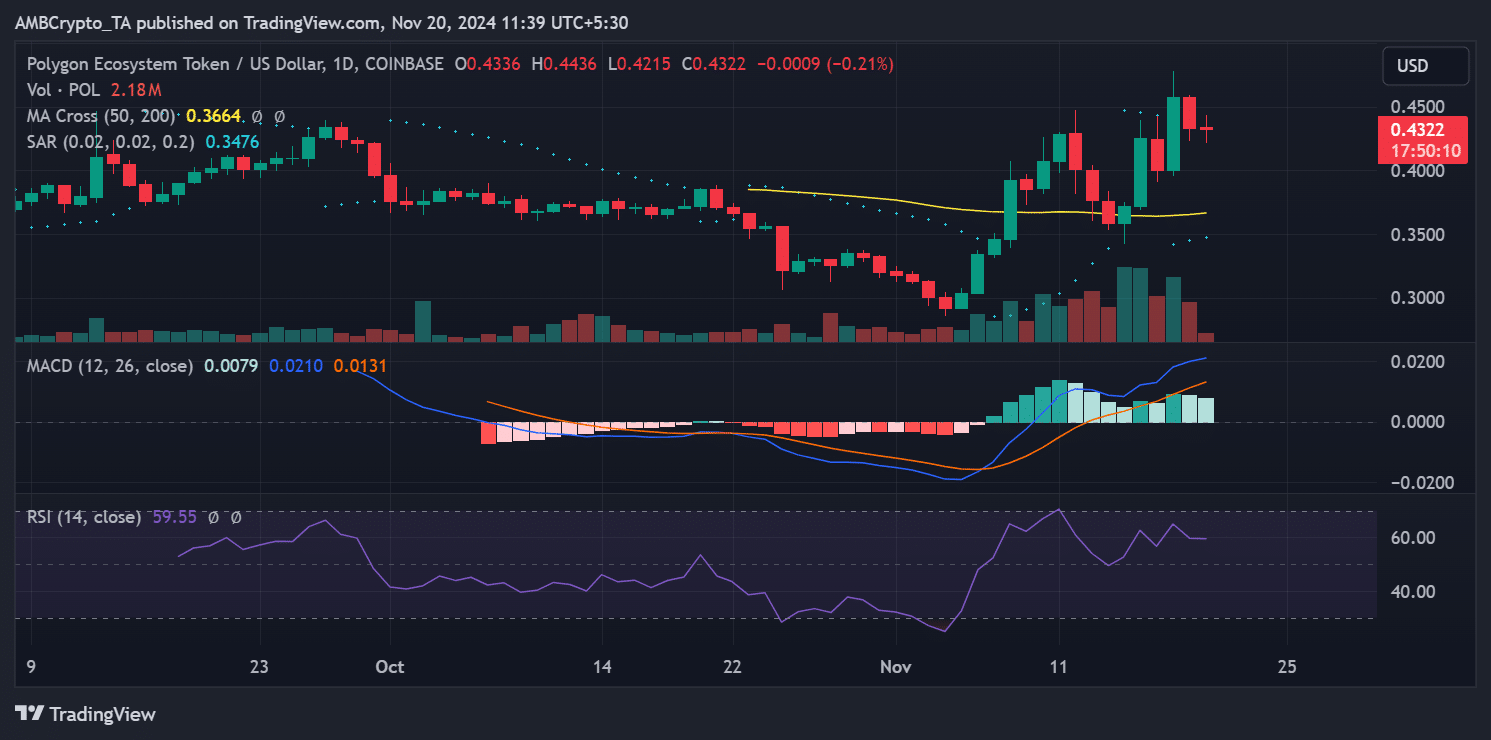

Technical indicators paint a mixed picture

The TradingView chart provided further insight into Polygon’s performance. Notably, the 50-day Moving Average(MA) sat above the 200-day MA, reflecting a near-term bullish cross.

However, POL remained below these critical levels, suggesting that momentum was still bearish.

The MACD indicator highlighted a weakening bullish momentum, with the histogram bars showing a potential reversal.

Meanwhile, the RSI hovered around 59, a neutral zone indicating consolidation rather than strong directional movement.

To regain positive traction, POL must break above resistance levels at $0.50 and $0.55 while maintaining consistent trading volume.

A sign of recovery or decline?

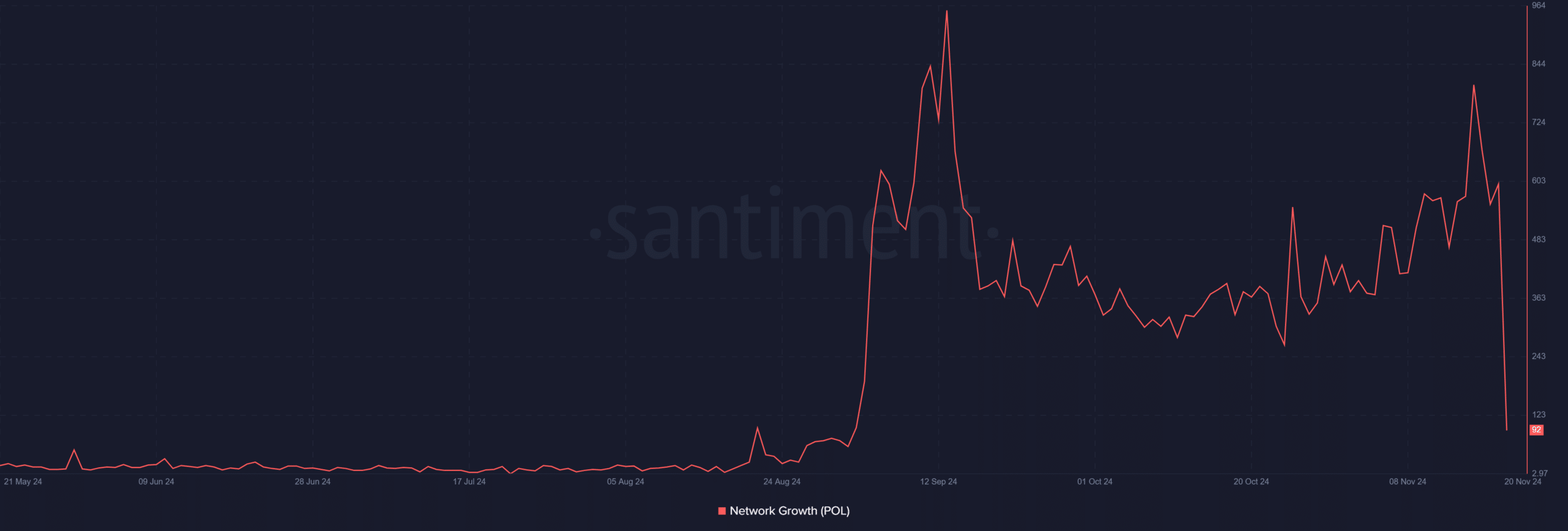

On-chain activity, as captured by Santiment’s network growth chart, revealed fluctuations in Polygon’s ecosystem engagement.

Recent spikes in network activity show intermittent interest in the platform, but the declining trend since early November reflects waning user and developer participation.

Strong network activity and ecosystem developments are essential for POL to regain footing.

Outlook for Polygon

Polygon’s current state reflected a difficult phase for its holders and ecosystem. With 81.60% of POL holders at a loss, market sentiment appears bleak.

Is your portfolio green? Check out the POL Profit Calculator

However, such conditions have historically served as turning points, offering opportunities for long-term investors.

POL’s trajectory depends on its ability to reclaim key technical levels and reinvigorate network growth. While the data indicates caution, it also presents a potential setup for recovery if broader market conditions improve.